Multiple Bottom Technical Pattern

Learn about the Multiple Bottom pattern in stock trading - a bullish reversal pattern that signals potential upward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Multiple Bottom Patterns

15 patterns found

Pursuit Attractions and Hospitality, Inc.

US

Market Cap: 1.05B

Industry: Travel Services

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

New Oriental Education & Technology Group Inc.

CN

Market Cap: 8.94B

Industry: Education & Training Services

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Heidelberger Druckmaschinen AG

DE

Market Cap: 237.71M

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Rakuten Group Inc

JP

Market Cap: 11.11B

Industry: Internet Retail

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Loar Holdings Inc.

US

Market Cap: 6.29B

Industry: Aerospace & Defense

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Quest Holdings S.A

GR

Market Cap: 807.41M

Industry: Electronics & Computer Distribution

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Churchill Downs Inc

US

Market Cap: 6.53B

Industry: Gambling

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

HEICO CORP

US

Market Cap: 44.14B

Industry: Aerospace & Defense

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

KBR Inc

US

Market Cap: 5.38B

Industry: Engineering & Construction

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

BIOINVENT INTERN. SK 2

SE

Market Cap: 191.90M

Multiple Bottom

2/26/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Bikurey Hasade Holdings Ltd

IL

Market Cap: 215.61M

Industry: Food Distribution

Multiple Bottom

2/25/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

XANO INDUSTRI AB B

SE

Market Cap: 249.90M

Multiple Bottom

2/25/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

AUBAY

FR

Market Cap: 694.72M

Industry: Information Technology Services

Multiple Bottom

2/25/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Capri Holdings Ltd

GB

Market Cap: 2.64B

Industry: Luxury Goods

Multiple Bottom

2/25/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Marine Products Corporation

US

Market Cap: 271.13M

Industry: Recreational Vehicles

Multiple Bottom

2/25/2026

Bullish pattern with three or more troughs at similar price levels, suggesting strong support

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Multiple Bottom Patterns

Multiple Bottom patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Multiple Bottom in Stocks

What is the Multiple Bottom Pattern in Stocks?

The Multiple Bottom pattern is a bullish reversal pattern that appears at the end of a downtrend, indicating a potential upward movement. This pattern forms when the price of a stock hits a low multiple times before rising again. It resembles the shape of several "W" formations on a price chart. In stock trading, the Multiple Bottom pattern is significant because it often marks the end of a bearish phase and the beginning of a bullish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Multiple Bottom Patterns

Identifying the Multiple Bottom pattern involves several key steps:

- Initial Decline: Look for a clear downtrend where the price reaches new lows.

- Multiple Bottoms: Observe the price hitting low points multiple times and rebounding to form peaks.

- Confirmation: After the last bottom, the price should rise and break above the peaks formed between the bottoms, confirming the pattern.

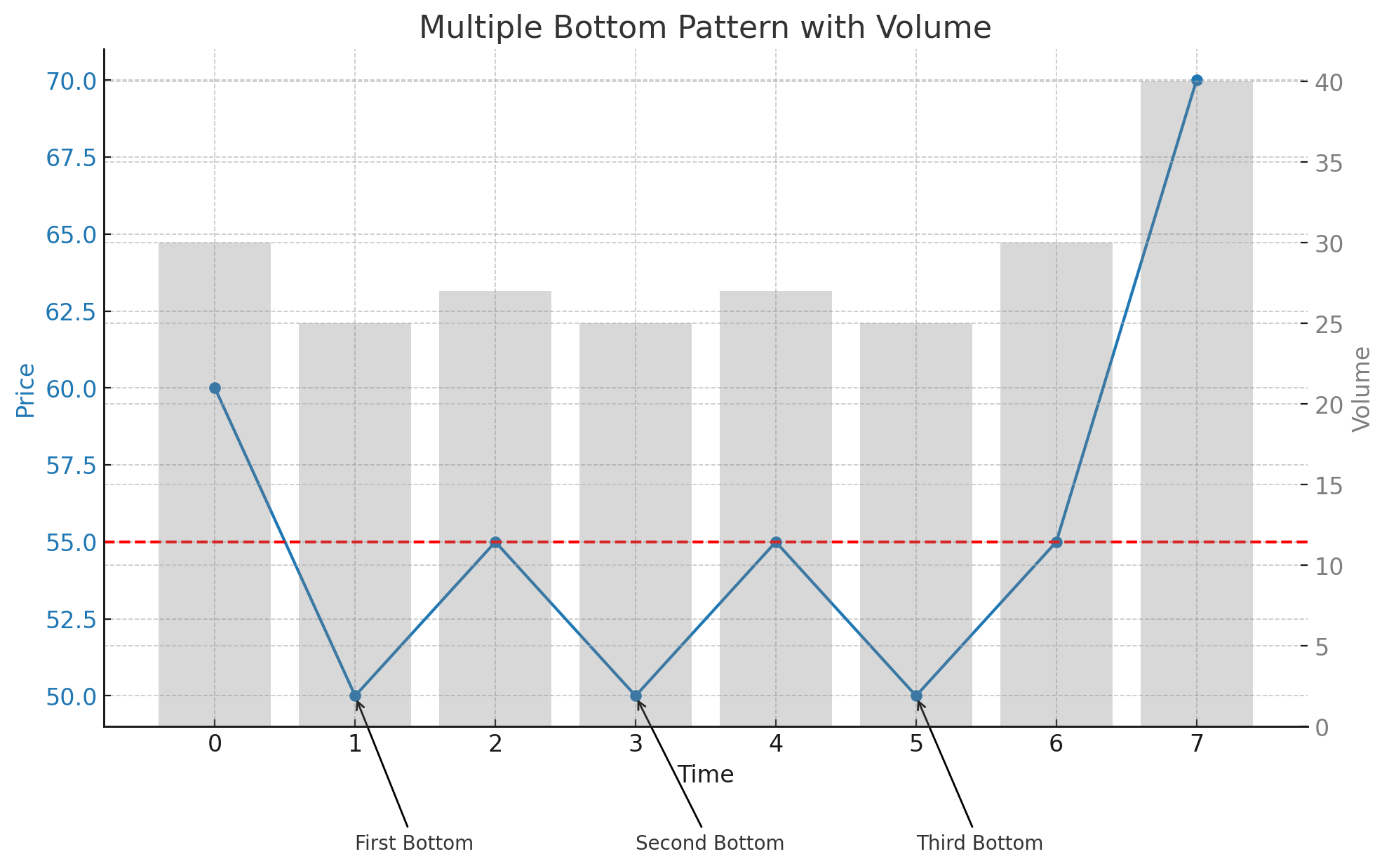

Identifying a Multiple Bottom Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Multiple Bottom pattern. Key elements to observe include the initial decline, the formation of the multiple bottoms, and the subsequent breakout.

- Initial Decline: The price of the stock shows a clear downtrend, indicating bearish market sentiment.

- Multiple Bottoms: The price hits low points (Points A, B, C, etc.) and then rebounds to form peaks.

- Breakout Confirmation: After the final bottom, the price rises and breaks above the peaks formed between the bottoms, confirming the pattern.

Multiple Bottom Pattern

Key Indicators

- Candlestick Patterns: Look for reversal candlestick patterns near the bottoms.

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong buying interest.

- Support Levels: The bottoms should align with significant support levels on the chart.

Multiple Bottom Pattern with Volume Analysis

This example highlights the role of volume in confirming the Multiple Bottom pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Initial Decline: The price trend is downward, characterized by decreasing prices and relatively low volume.

- Multiple Bottoms: The price reaches low points with moderate volume as buyers begin to enter the market.

- Rebound to Peaks: The price rises from each bottom, but volume remains moderate.

- Breakout Confirmation: The price breaks above the peaks formed between the bottoms, accompanied by a significant spike in volume, confirming the pattern.

Multiple Bottom Pattern with Volume

Frequently Asked Questions

What is the Multiple Bottom pattern in stock trading?

The Multiple Bottom pattern in stock trading is a bullish reversal pattern that appears at the end of a downtrend. It indicates a potential upward movement and is characterized by the price hitting a low point multiple times before rising again.

How reliable is the Multiple Bottom pattern in stocks?

The Multiple Bottom pattern is considered a reliable bullish reversal signal in stock trading, especially when confirmed by increased trading volume and a strong breakout above the peaks formed between the bottoms. However, it should be used alongside other technical analysis tools.

Can the Multiple Bottom pattern appear in any stock?

Yes, the Multiple Bottom pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Multiple Bottom pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Multiple Bottom pattern, traders can better anticipate bullish reversals and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Multiple Bottom pattern in stocks?

Key indicators include identifying significant support levels, confirming the pattern with increased volume during the breakout, and observing reversal candlestick patterns near the bottoms. These indicators help validate the Multiple Bottom pattern and provide insights for potential significant price movements.