Golden Cross Technical Pattern

Learn about the Golden Cross pattern in stock trading - a bullish reversal pattern that occurs when short-term moving average crosses above long-term moving average. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Golden Cross Patterns

15 patterns found

ENERGY SERVICES OF AMERICA CORP

US

Market Cap: 236.72M

Industry: Engineering & Construction

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Carlisle Companies Inc

US

Market Cap: 16.72B

Industry: Bauausrüstung und Produkte

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Fastned B.V

NL

Market Cap: 508.87M

Industry: Specialty Retail

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Extra Space Storage Inc

US

Market Cap: 32.47B

Industry: REIT - Industrial

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

AAON Inc

US

Market Cap: 8.20B

Industry: Building Products & Equipment

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Boise Cascad Llc

US

Market Cap: 3.09B

Industry: Lumber & Wood Production

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

CF Industries Holdings Inc

US

Market Cap: 14.90B

Industry: Agricultural Inputs

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Pactiv Evergreen Inc

US

Market Cap: 3.24B

Industry: Packaging & Containers

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

National Retail Properties Inc

US

Market Cap: 8.42B

Industry: REIT - Retail

Golden Cross

2/27/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Kaufman & Broad S.A

FR

Market Cap: 778.93M

Golden Cross

2/26/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Intrepid Potash Inc

US

Market Cap: 459.54M

Industry: Landwirtschaftliche Betriebsmittel

Golden Cross

2/26/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Austevoll Seafood ASA

NO

Market Cap: 2.10B

Industry: Farm Products

Golden Cross

2/26/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

PCC Rokita SA

PL

Market Cap: 343.05M

Industry: Chemikalien

Golden Cross

2/26/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

ITAB AB

US

Market Cap: 9.30B

Industry: Beverages - Brewers

Golden Cross

2/26/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Celanese Corp

US

Market Cap: 5.93B

Industry: Chemicals

Golden Cross

2/26/2026

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Golden Cross Patterns

Golden Cross patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Golden Cross in Stocks

What is the Golden Cross Pattern in Stocks?

The Golden Cross pattern is a bullish reversal pattern that occurs when a short-term moving average crosses above a long-term moving average. This pattern signifies a potential upward movement in stock prices and is considered a strong signal of a bullish trend. In stock trading, the Golden Cross pattern is significant because it often marks the transition from a bearish phase to a bullish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Golden Cross Patterns

Identifying the Golden Cross pattern involves several key steps:

- Downtrend: Look for a clear downtrend in the stock's price.

- Short-Term Moving Average: The short-term moving average (e.g., 50-day MA) crosses above the long-term moving average (e.g., 200-day MA).

- Confirmation: The crossover should be accompanied by increased trading volume, confirming the pattern.

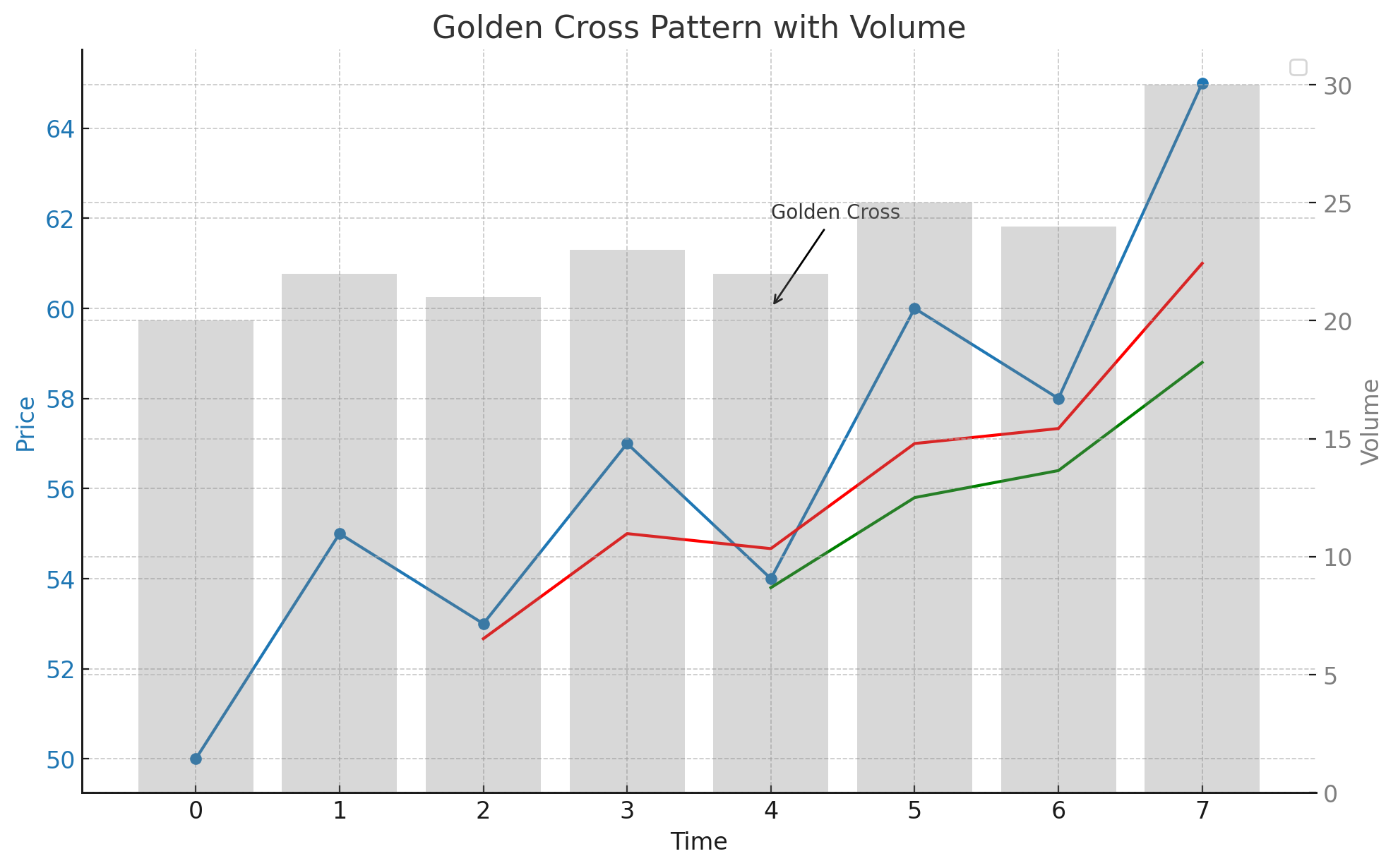

Identifying a Golden Cross Pattern

In this example, we use a typical stock chart to illustrate the formation of a Golden Cross pattern. Key elements to observe include the downtrend, the crossover of moving averages, and the subsequent increase in stock price.

- Downtrend: The price of the stock shows a clear downward trend leading into the pattern.

- Crossover: The short-term moving average crosses above the long-term moving average.

- Breakout Confirmation: The price rises after the crossover, confirming the pattern.

Golden Cross Pattern

Key Indicators

- Moving Averages: The short-term moving average crossing above the long-term moving average.

- Volume Spikes: Increased trading volume often accompanies the crossover, indicating strong buying interest.

- Support Levels: The crossover should occur near significant support levels on the chart.

Golden Cross Pattern with Volume Analysis

This example highlights the role of volume in confirming the Golden Cross pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Downtrend: The price trend is downward, characterized by decreasing prices and moderate volume.

- Crossover: The short-term moving average crosses above the long-term moving average with moderate volume.

- Breakout: The price rises after the crossover with a significant spike in volume, confirming the pattern.

Golden Cross Pattern with Volume

Frequently Asked Questions

What is the Golden Cross pattern in stock trading?

The Golden Cross pattern in stock trading is a bullish reversal pattern that occurs when a short-term moving average crosses above a long-term moving average. It signifies a potential upward movement in stock prices and is considered a strong signal of a bullish trend.

How reliable is the Golden Cross pattern in stocks?

The Golden Cross pattern is considered a reliable bullish reversal signal in stock trading, especially when confirmed by increased trading volume and a strong price movement after the crossover. However, it should be used alongside other technical analysis tools.

Can the Golden Cross pattern appear in any stock?

Yes, the Golden Cross pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Golden Cross pattern?

Common mistakes include entering the trade too early before the crossover confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Golden Cross pattern, traders can better anticipate bullish reversals and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Golden Cross pattern in stocks?

Key indicators include the short-term moving average crossing above the long-term moving average, confirming the pattern with increased volume during the crossover, and observing bullish price movements after the crossover. These indicators help validate the Golden Cross pattern and provide insights for potential significant price movements.