Descending Triangle BreakOut Technical Pattern

Learn about the Triangle Bullish Breakout pattern in stock trading - a continuation pattern that signals potential upward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Descending Triangle BreakOut Patterns

15 patterns found

Prime Medicine Inc

US

Market Cap: 703.00M

Industry: Biotechnology

Descending Triangle BreakOut

2/25/2026

Bullish pattern often leading to a trend reversal

Tabcorp Holdings Ltd

AU

Market Cap: 1.69B

Industry: Gambling

Descending Triangle BreakOut

2/25/2026

Bullish pattern often leading to a trend reversal

Nextdoor Holdings Inc

US

Market Cap: 687.66M

Industry: Internet Content & Information

Descending Triangle BreakOut

2/20/2026

Bullish pattern often leading to a trend reversal

SunCar Technology Group Inc.

CN

Market Cap: 230.54M

Industry: Auto & Truck Dealerships

Descending Triangle BreakOut

2/20/2026

Bullish pattern often leading to a trend reversal

Baozun Inc

CN

Market Cap: 149.16M

Industry: Internet Retail

Descending Triangle BreakOut

2/19/2026

Bullish pattern often leading to a trend reversal

MEDIBANK PRIVATE LTD

AU

Market Cap: 8.82B

Industry: Insurance - Specialty

Descending Triangle BreakOut

2/18/2026

Bullish pattern often leading to a trend reversal

Oryzon Genomics S.A

ES

Market Cap: 285.03M

Descending Triangle BreakOut

2/18/2026

Bullish pattern often leading to a trend reversal

Cronos Group Inc

CA

Market Cap: 968.72M

Industry: Drug Manufacturers - Specialty & Generic

Descending Triangle BreakOut

2/18/2026

Bullish pattern often leading to a trend reversal

Chariot Corp Ltd

GG

Market Cap: 32.63M

Industry: Oil & Gas E&P

Descending Triangle BreakOut

2/18/2026

Bullish pattern often leading to a trend reversal

Connect Biopharma Holdings Ltd

US

Market Cap: 163.45M

Industry: Biotechnology

Descending Triangle BreakOut

2/17/2026

Bullish pattern often leading to a trend reversal

Fennec Pharmaceuticals Inc

US

Market Cap: 228.69M

Industry: Biotechnology

Descending Triangle BreakOut

2/13/2026

Bullish pattern often leading to a trend reversal

Exelon Corp

US

Market Cap: 49.11B

Industry: Utilities - Regulated Electric

Descending Triangle BreakOut

2/12/2026

Bullish pattern often leading to a trend reversal

Vestum

SE

Market Cap: 334.32M

Industry: Baugewerbe

Descending Triangle BreakOut

2/12/2026

Bullish pattern often leading to a trend reversal

RESERVOIR MEDIA INC

US

Market Cap: 491.26M

Industry: Entertainment

Descending Triangle BreakOut

2/9/2026

Bullish pattern often leading to a trend reversal

Bureau Veritas SA

FR

Market Cap: 15.03B

Industry: Consulting Services

Descending Triangle BreakOut

2/6/2026

Bullish pattern often leading to a trend reversal

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Descending Triangle BreakOut Patterns

Descending Triangle BreakOut patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Triangle Bullish Breakout in Stocks

What is the Triangle Bullish Breakout Pattern in Stocks?

The Triangle Bullish Breakout pattern is a continuation pattern that appears during an uptrend, indicating a potential continuation of the upward movement. This pattern forms when the price of a stock consolidates within converging trendlines, creating a triangular shape, before breaking out to the upside. In stock trading, the Triangle Bullish Breakout pattern is significant because it often signals the continuation of a bullish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Triangle Bullish Breakout Patterns

Identifying the Triangle Bullish Breakout pattern involves several key steps:

- Uptrend: Look for a clear uptrend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout: The price breaks above the upper trendline, confirming the pattern.

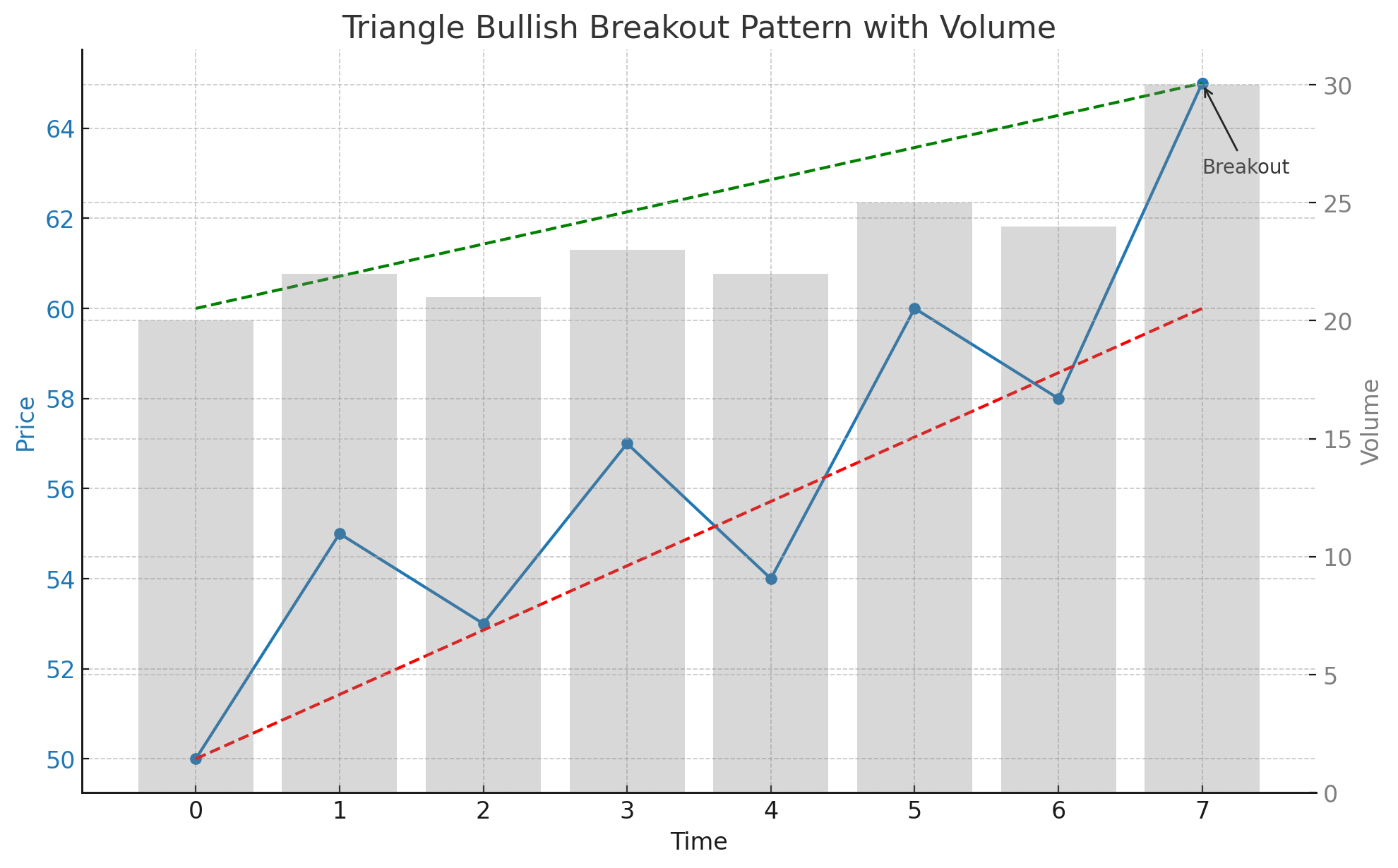

Identifying a Triangle Bullish Breakout Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Triangle Bullish Breakout pattern. Key elements to observe include the uptrend, the consolidation phase, and the subsequent breakout.

- Uptrend: The price of the stock shows a clear upward trend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout Confirmation: The price breaks above the upper trendline, confirming the pattern.

Triangle Bullish Breakout Pattern

Key Indicators

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong buying interest.

- Trendlines: Converging trendlines forming the triangle.

- Candlestick Patterns: Look for bullish candlestick patterns near the breakout point.

Triangle Bullish Breakout Pattern with Volume Analysis

This example highlights the role of volume in confirming the Triangle Bullish Breakout pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Uptrend: The price trend is upward, characterized by increasing prices and moderate volume.

- Consolidation: The price consolidates within converging trendlines with moderate volume.

- Breakout: The price breaks above the upper trendline with a significant spike in volume, confirming the pattern.

Triangle Bullish Breakout Pattern with Volume

Frequently Asked Questions

What is the Triangle Bullish Breakout pattern in stock trading?

The Triangle Bullish Breakout pattern in stock trading is a continuation pattern that appears during an uptrend. It indicates a potential continuation of the upward movement and is characterized by the price consolidating within converging trendlines before breaking out to the upside.

How reliable is the Triangle Bullish Breakout pattern in stocks?

The Triangle Bullish Breakout pattern is considered a reliable bullish continuation signal in stock trading, especially when confirmed by increased trading volume and a strong breakout above the upper trendline. However, it should be used alongside other technical analysis tools.

Can the Triangle Bullish Breakout pattern appear in any stock?

Yes, the Triangle Bullish Breakout pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Triangle Bullish Breakout pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Triangle Bullish Breakout pattern, traders can better anticipate bullish continuations and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Triangle Bullish Breakout pattern in stocks?

Key indicators include identifying significant trendlines, confirming the pattern with increased volume during the breakout, and observing bullish candlestick patterns near the breakout point. These indicators help validate the Triangle Bullish Breakout pattern and provide insights for potential significant price movements.