Ascending Triangle BreakDown Technical Pattern

Learn about the Triangle Bearish Breakout pattern in stock trading - a continuation pattern that signals potential downward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Ascending Triangle BreakDown Patterns

15 patterns found

indie Semiconductor Inc

US

Market Cap: 737.51M

Industry: Halbleiter Zubehör & Materialien

Ascending Triangle BreakDown

2/19/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

VRG S.A.

PL

Market Cap: 329.05M

Industry: Apparel Manufacturing

Ascending Triangle BreakDown

2/18/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

AC Immune Ltd

CH

Market Cap: 288.42M

Industry: Biotechnology

Ascending Triangle BreakDown

2/18/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Akso Health Group

CN

Market Cap: 1.15B

Industry: Medical Distribution

Ascending Triangle BreakDown

2/17/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Dotdigital Group Plc

GB

Market Cap: 277.99M

Industry: Software - Application

Ascending Triangle BreakDown

2/17/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

TechTarget Inc

US

Market Cap: 376.66M

Industry: Information Technology Services

Ascending Triangle BreakDown

2/13/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

CapMan Oyj

FI

Market Cap: 381.32M

Ascending Triangle BreakDown

2/12/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

1-800 FLOWERS.COM Inc

US

Market Cap: 303.05M

Industry: Specialty Retail

Ascending Triangle BreakDown

2/12/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Clarus Corp

US

Market Cap: 143.62M

Industry: Leisure

Ascending Triangle BreakDown

2/12/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

AMERICAS CARMART INC

US

Market Cap: 193.88M

Industry: Auto & Truck Dealerships

Ascending Triangle BreakDown

2/10/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Borgestad A

NO

Market Cap: 201.39M

Industry: Building Products & Equipment

Ascending Triangle BreakDown

2/9/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Pacific Biosciences of California Inc

US

Market Cap: 667.22M

Industry: Medizinische Instrumente & Zubehör

Ascending Triangle BreakDown

2/5/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Canada Goose Holdings Inc

CA

Market Cap: 1.01B

Industry: Apparel Manufacturing

Ascending Triangle BreakDown

2/5/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Elders Ltd

AU

Market Cap: 943.00M

Industry: Farm Products

Ascending Triangle BreakDown

2/5/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

ATLAS ARTERIA

AU

Market Cap: 4.89B

Industry: Infrastructure Operations

Ascending Triangle BreakDown

2/4/2026

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Ascending Triangle BreakDown Patterns

Ascending Triangle BreakDown patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Triangle Bearish Breakout in Stocks

What is the Triangle Bearish Breakout Pattern in Stocks?

The Triangle Bearish Breakout pattern is a continuation pattern that appears during a downtrend, indicating a potential continuation of the downward movement. This pattern forms when the price of a stock consolidates within converging trendlines, creating a triangular shape, before breaking out to the downside. In stock trading, the Triangle Bearish Breakout pattern is significant because it often signals the continuation of a bearish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Triangle Bearish Breakout Patterns

Identifying the Triangle Bearish Breakout pattern involves several key steps:

- Downtrend: Look for a clear downtrend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout: The price breaks below the lower trendline, confirming the pattern.

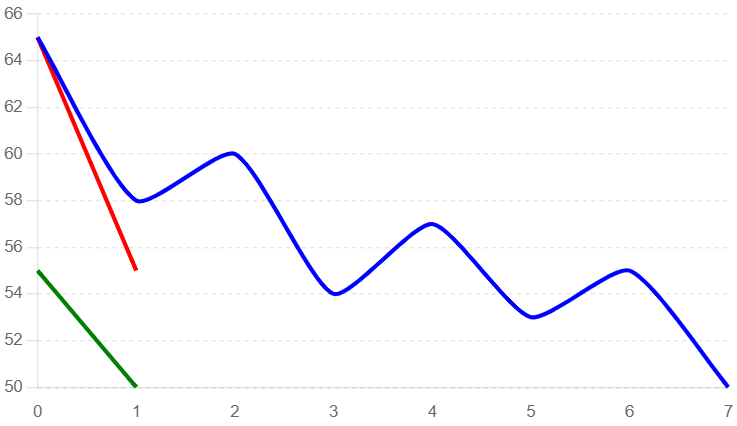

Identifying a Triangle Bearish Breakout Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Triangle Bearish Breakout pattern. Key elements to observe include the downtrend, the consolidation phase, and the subsequent breakout.

- Downtrend: The price of the stock shows a clear downward trend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout Confirmation: The price breaks below the lower trendline, confirming the pattern.

Triangle Bearish Breakout Pattern

Key Indicators

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong selling interest.

- Trendlines: Converging trendlines forming the triangle.

- Candlestick Patterns: Look for bearish candlestick patterns near the breakout point.

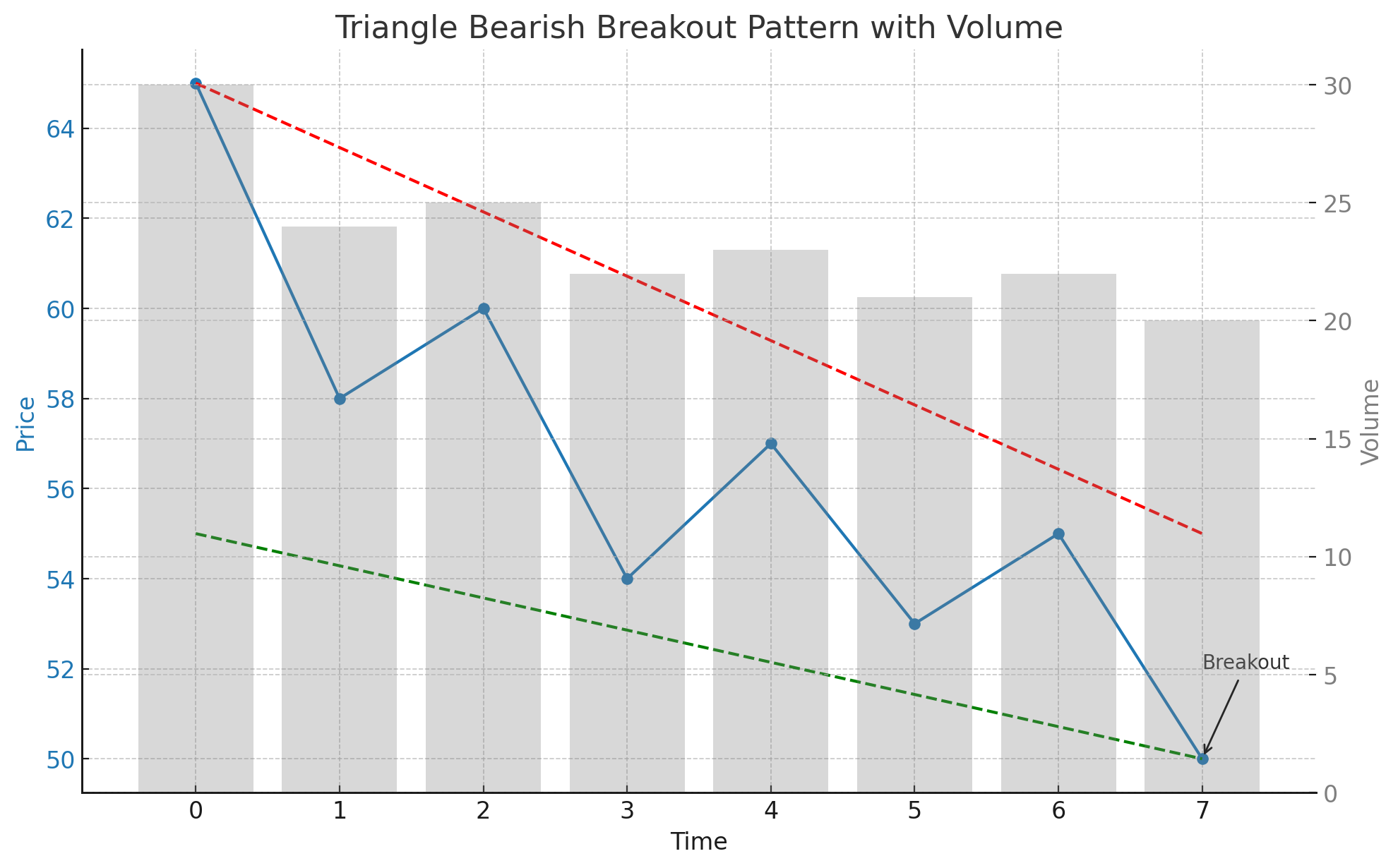

Triangle Bearish Breakout Pattern with Volume Analysis

This example highlights the role of volume in confirming the Triangle Bearish Breakout pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Downtrend: The price trend is downward, characterized by decreasing prices and moderate volume.

- Consolidation: The price consolidates within converging trendlines with moderate volume.

- Breakout: The price breaks below the lower trendline with a significant spike in volume, confirming the pattern.

Triangle Bearish Breakout Pattern with Volume

Frequently Asked Questions

What is the Triangle Bearish Breakout pattern in stock trading?

The Triangle Bearish Breakout pattern in stock trading is a continuation pattern that appears during a downtrend. It indicates a potential continuation of the downward movement and is characterized by the price consolidating within converging trendlines before breaking out to the downside.

How reliable is the Triangle Bearish Breakout pattern in stocks?

The Triangle Bearish Breakout pattern is considered a reliable bearish continuation signal in stock trading, especially when confirmed by increased trading volume and a strong breakout below the lower trendline. However, it should be used alongside other technical analysis tools.

Can the Triangle Bearish Breakout pattern appear in any stock?

Yes, the Triangle Bearish Breakout pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Triangle Bearish Breakout pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Triangle Bearish Breakout pattern, traders can better anticipate bearish continuations and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Triangle Bearish Breakout pattern in stocks?

Key indicators include identifying significant trendlines, confirming the pattern with increased volume during the breakout, and observing bearish candlestick patterns near the breakout point. These indicators help validate the Triangle Bearish Breakout pattern and provide insights for potential significant price movements.