Most Investors Misunderstand Trading Signals and Pay the Price

For most active investors, the first interaction with the market each day is a trading signal. A stock alert flashes on the screen, a notification buzzes on the phone, or a price level breaks during a fast-moving session.

In theory, that signal is supposed to help clarify what is happening. In reality, for many traders, it does the opposite: it creates urgency without understanding, pressure without conviction, which leads to rushed decisions that feel more reactive than intentional.

More often than not, these decisions lead to bad outcomes.

This is the quiet frustration behind countless trading days that feel busy but unproductive. Traders are surrounded by stock price alerts, random notifications, and so-called high-probability signals, yet still feel late, uncertain, and emotionally drained.

The issue is not that trading signals do not work. The issue is that most of them arrive without context.

Markets do not move randomly. They move when forces align. And trading signals are supposed to explain those forces.

In this article, we break down what separates real trading signals from market noise, how to recognize them early, and what successful traders actually look for before they act.

What Are Trading Signals and How Can You Spot Them?

To understand what trading signals are, it helps to step away from indicators and look at intent.

A real trading signal is not meant to instruct you to buy or sell. It is meant to draw your attention to an imbalance forming beneath the surface of price. That imbalance might come from technical pressure, sentiment shifts, insider behavior, analyst positioning, or a developing narrative that has not yet fully expressed itself in price.

In other words, it’s an event, activity or factor that is disrupting the status quo.

Most platforms that deliver trading signals for stocks ignore this complexity. They reduce the market to isolated triggers and present them as actionable insights.

A breakout is treated the same whether it is supported by sentiment or fighting against it. News is delivered without showing whether price was already positioned for it. Volume spikes are flagged without explaining their source.

Essentially, they are but a notification. They lack context and rarely provide actionable insights.

This is why so many day trading signals fail to follow through, why they often reverse violently, and why traders struggle to trust even the setups that appear technically sound.

Why Traditional Stock Alerts Fail Active Traders

The modern trading environment is saturated with notifications. Every platform claims to offer the best stock alerts, the fastest execution, and the smartest indicators. Yet most traders feel more overwhelmed than ever.

Generic stock alert systems treat all events as equal. A minor fluctuation triggers the same urgency as a meaningful corporate development. Over time, traders either start ignoring alerts entirely or reacting emotionally without understanding what actually matters. They begin chasing moves they do not fully believe in.

What traders need is not more alerts, but the opposite: fewer alerts that provide quality signals. They want to know whether a move is meaningful before it becomes obvious.

What Trading Signals Are Worth Paying Attention to?

A high-quality trading signal explains why price is moving now, what forces are involved, and whether those forces are strengthening or weakening. Without that context, speed and immediacy simply accelerate mistakes.

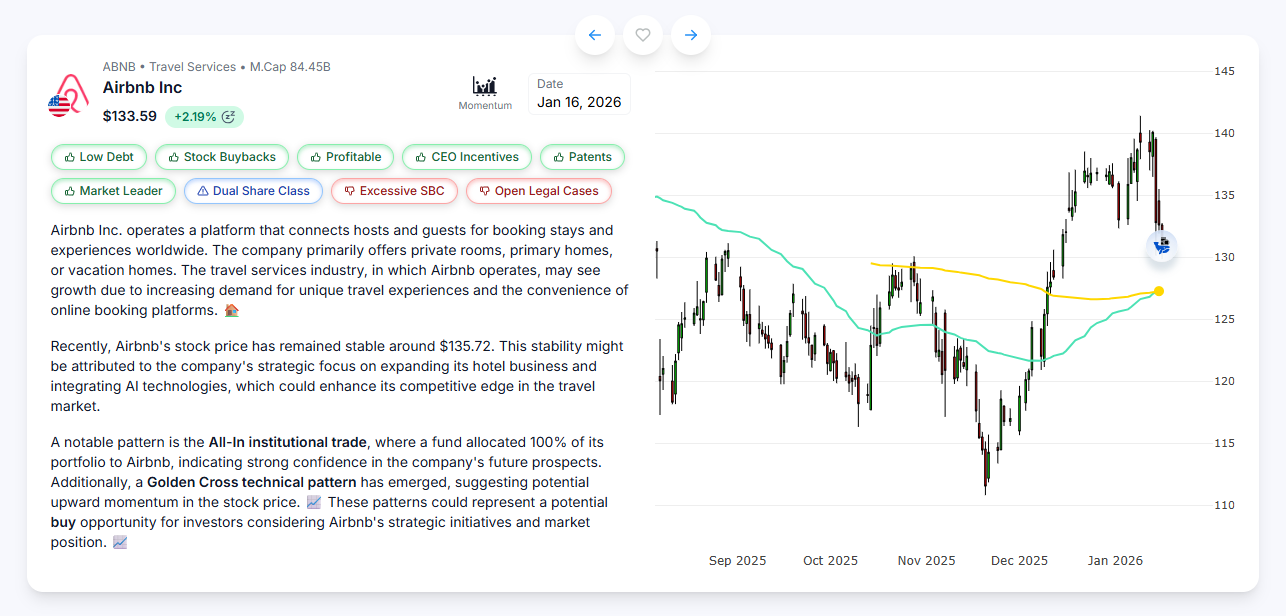

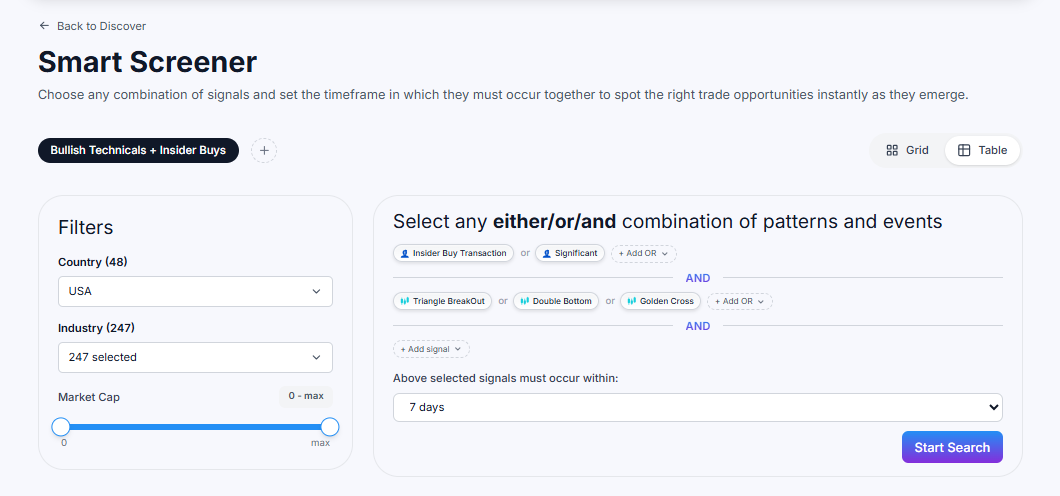

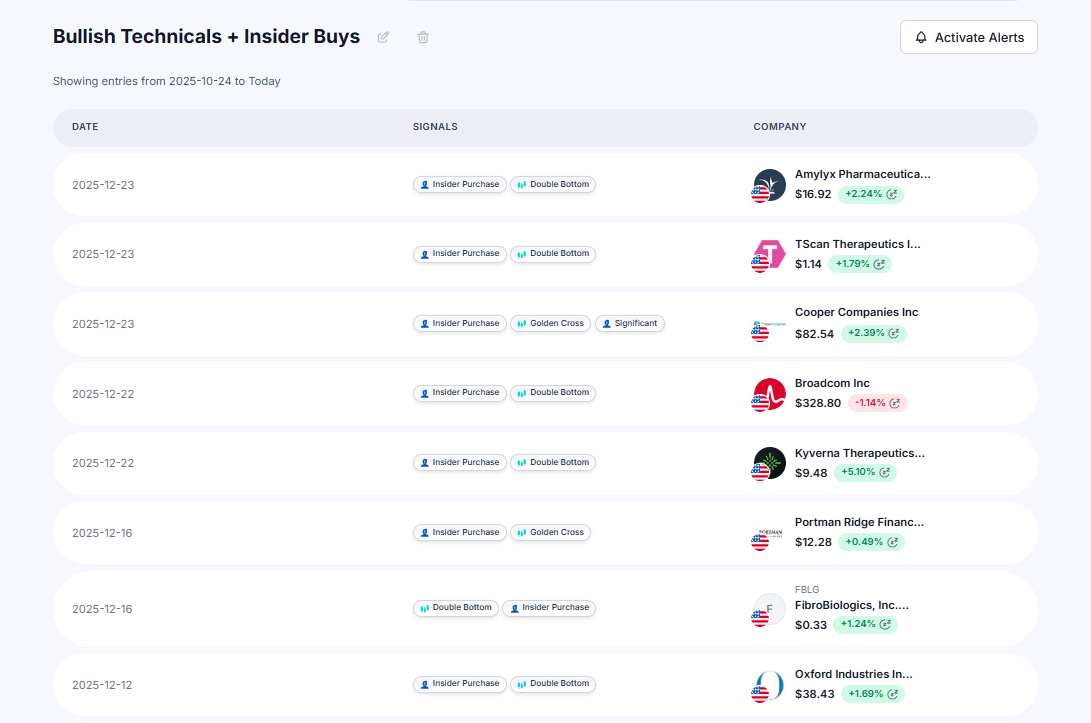

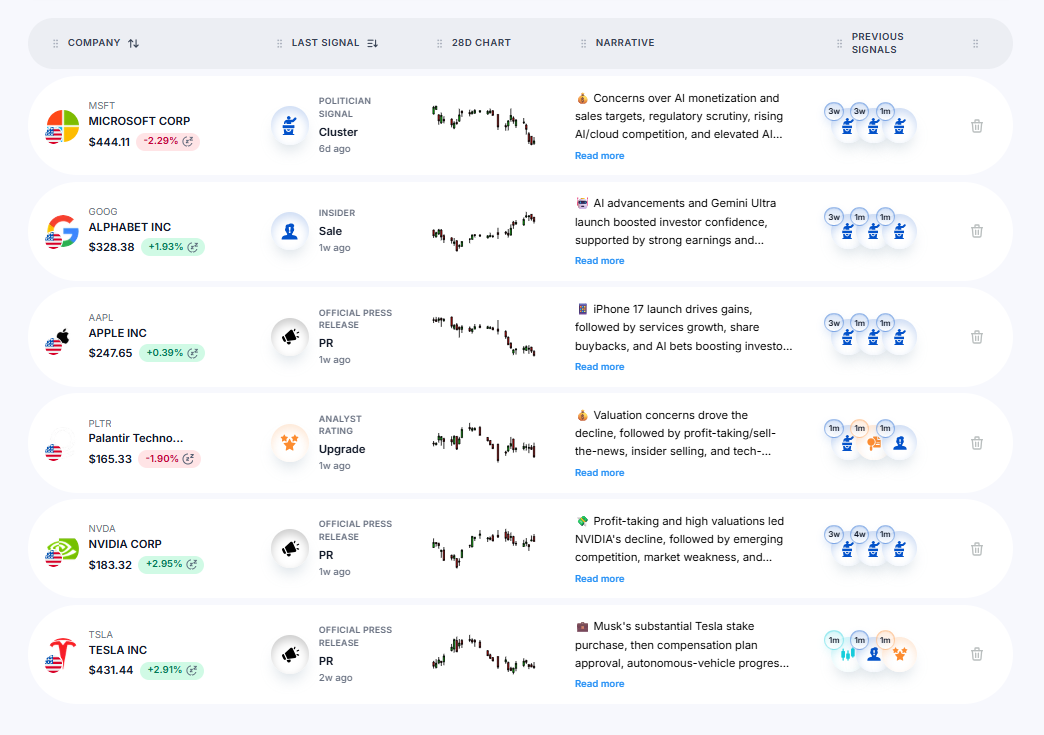

MarketAlerts approaches trading signals for the stock market from this perspective. Instead of delivering isolated triggers, it connects technical patterns with market sentiment, insider activity, analyst updates, corporate events, and broader narratives.

Each signal works within a framework that helps traders evaluate relevance and assess the full picture before acting. The experience is highly customizable, allowing you to receive exactly what you want to know as it happens.

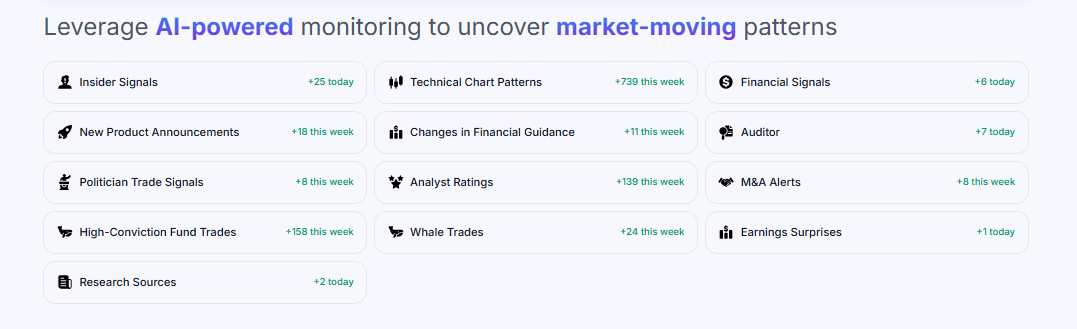

You can choose exactly which types of signals you want to monitor. You can receive alerts from individual signal categories or be notified only when multiple signals occur together, allowing you to focus on the combinations that matter most to your strategy. Signal categories include:

Insider Signals: Tracks buying and selling activity from company insiders to reveal confidence or concern from those closest to the business.

Technical Chart Patterns: Detects emerging and confirmed chart patterns that signal potential shifts in price momentum or trend direction.

Financial Signals: Monitors key financial metrics and balance sheet changes that may impact a company’s valuation or risk profile.

New Product Announcements: Identifies product launches and innovation updates that could influence future revenue and market perception.

Changes in Financial Guidance: Flags updates to company forecasts that may indicate improving or deteriorating business conditions.

Auditor: Highlights auditor changes or audit-related events that can signal governance issues or financial risk.

Politician Trade Signals: Tracks stock trades made by politicians to surface unusual or potentially informative investment activity.

Analyst Ratings: Captures upgrades, downgrades, and changes in analyst sentiment that can affect market expectations.

M&A Alerts: Detects merger, acquisition, and takeover activity that may drive abrupt repricing of a stock.

High-Conviction Fund Trades: Monitors concentrated or high-confidence positions taken by institutional funds.

Whale Trades: Identifies unusually large trades that may indicate activity from major market participants.

Earnings Surprises: Flags earnings results that significantly beat or miss expectations, often triggering sharp price moves.

Research Sources: Aggregates insights from credible research publications to surface emerging themes and informed perspectives.

Imagine a stock is going up, but whales and investment funds have started selling aggressively. Seen separately, these indicators signal different things. Yet, when you analyze them together, they reveal a common pattern that usually means a correction is coming.

These are the signals professional and successful traders look for: those that allow them to understand context and market conditions rather than isolated events. And that is why these traders view MarketAlerts as the best stock alert service: not because it sends more alerts, but because it allows them to customize them to their preferences, detect and receive exactly what they are looking for, and avoid noise to make better trading decisions.

Create your free MarketAlerts account and start using trading signals to spot hidden opportunities.

Trading Signals Across Real Trading Strategies

Different traders need different types of confirmation.

Intraday trading signals must surface early pressure before momentum becomes crowded.

Day trading signals require tight alignment between structure, volume, and market tone.

Swing trading signals often develop quietly over time, demanding patience and narrative consistency.

Equity trading signals for longer-term positioning depend on durable fundamentals and sustained sentiment shifts.

MarketAlerts respects these differences. Traders define their own filters, strategies, and timeframes, ensuring signals align with their approach rather than forcing adaptation to generic templates.

This flexibility is what turns alerts into tools instead of distractions.

How to Build High-Performing Trading Strategies With AI

The real value of AI in trading is not prediction: It’s pattern recognition at scale.

Successful traders use MarketAlerts to identify relationships across massive datasets, surfacing AI trading signals when multiple forces begin aligning. This reduces cognitive overload and helps traders see what matters without drowning in irrelevant information.

Instead of optimizing around single indicators, traders build systems based on convergence, context, and repeatability. And they use AI for confirmation rather than direct decision-making.

Stop Reacting and Start Going for High-Conviction Plays

When traders understand why a trading signal exists and how to read it, everything changes. Alerts stop feeling urgent. Decisions slow down without becoming hesitant. Trades are evaluated against a plan instead of emotion.

This shift is what separates traders who constantly chase the market from those who build durable day trading strategies that survive different market conditions.

MarketAlerts does not promise certainty. That is simply impossible. What it offers is clarity in a market overwhelmed by noise.

And clarity is where consistency begins.

Experience it yourself. Create a free MarketAlerts.ai account and see how real trading signals bring clarity to the market.