The stock market doesn't care about your hard work. It only rewards the people who see the move before everyone else. Sometimes, something as simple as using high-quality trading alerts based on stock signals is all you need to become one of them.

But what exactly are these trading alerts and how do you set them up?

Investing in equities without a clear strategy is like sailing in open waters without a compass. Most investors rely on fragmented information or outdated indicators, which not only makes them miss precious opportunities, but also make poor decisions leading to bad outcomes, which is even more costly.

Where regular alerts would simply send you a notification when a stock reaches a certain price, the trading alerts and stock signals we are talking about are designed to give you that compass, detecting underlying patterns and detecting high-potential stocks before the market catches on.

Understanding what these stock signals are and how to combine them effectively into trading alerts can be the difference between mediocre returns and exceptional performance.

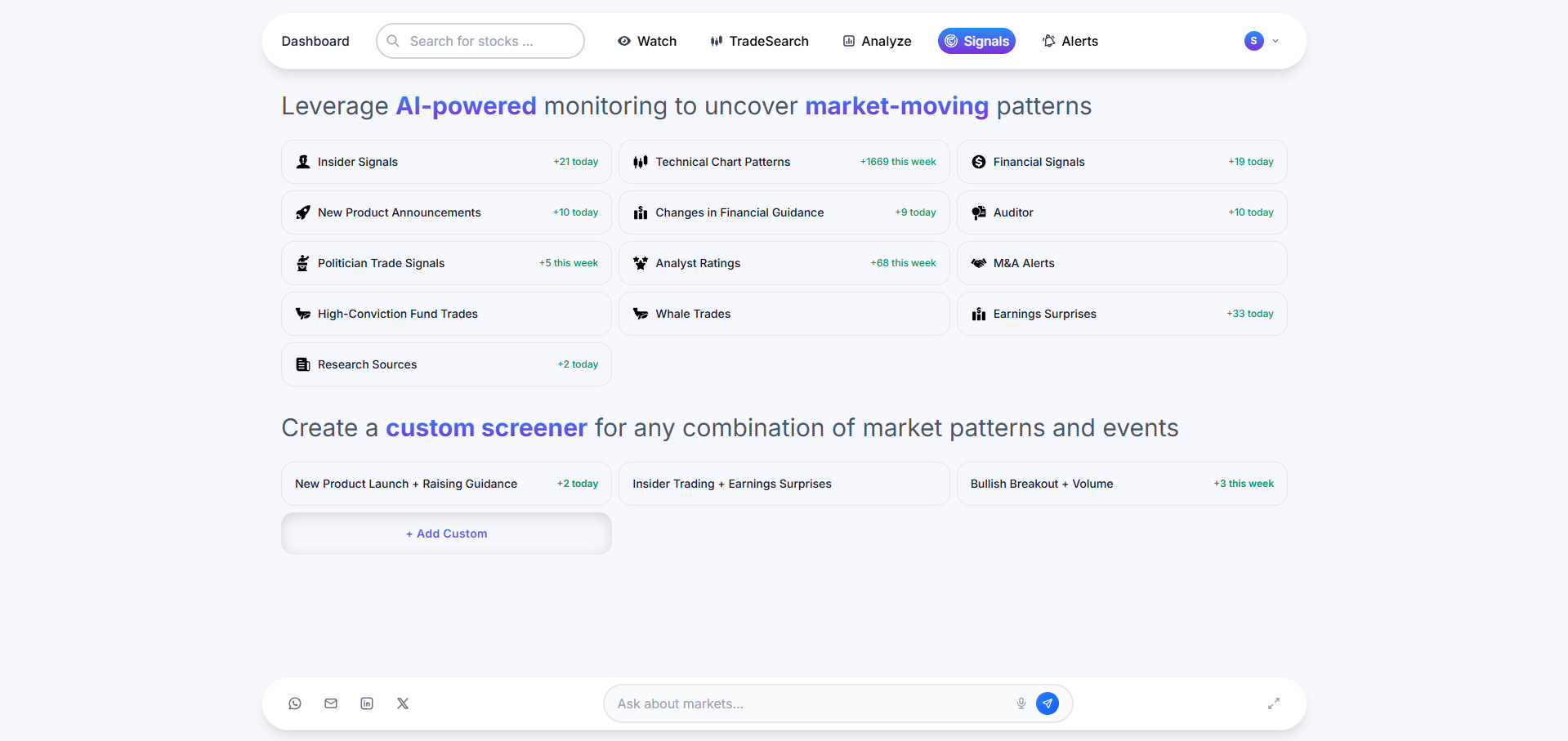

In this article, we explore three actionable strategies based on stock signals that can guide investors toward high-potential stocks. Each strategy combines multiple signals and trading alerts to help you find the best stocks to invest in, providing both technical and fundamental context.

Strategy #1: Momentum Breakouts Confirmed by High Volume Transactions

Momentum trading is one of the most widely used approaches for short and medium-term investors.

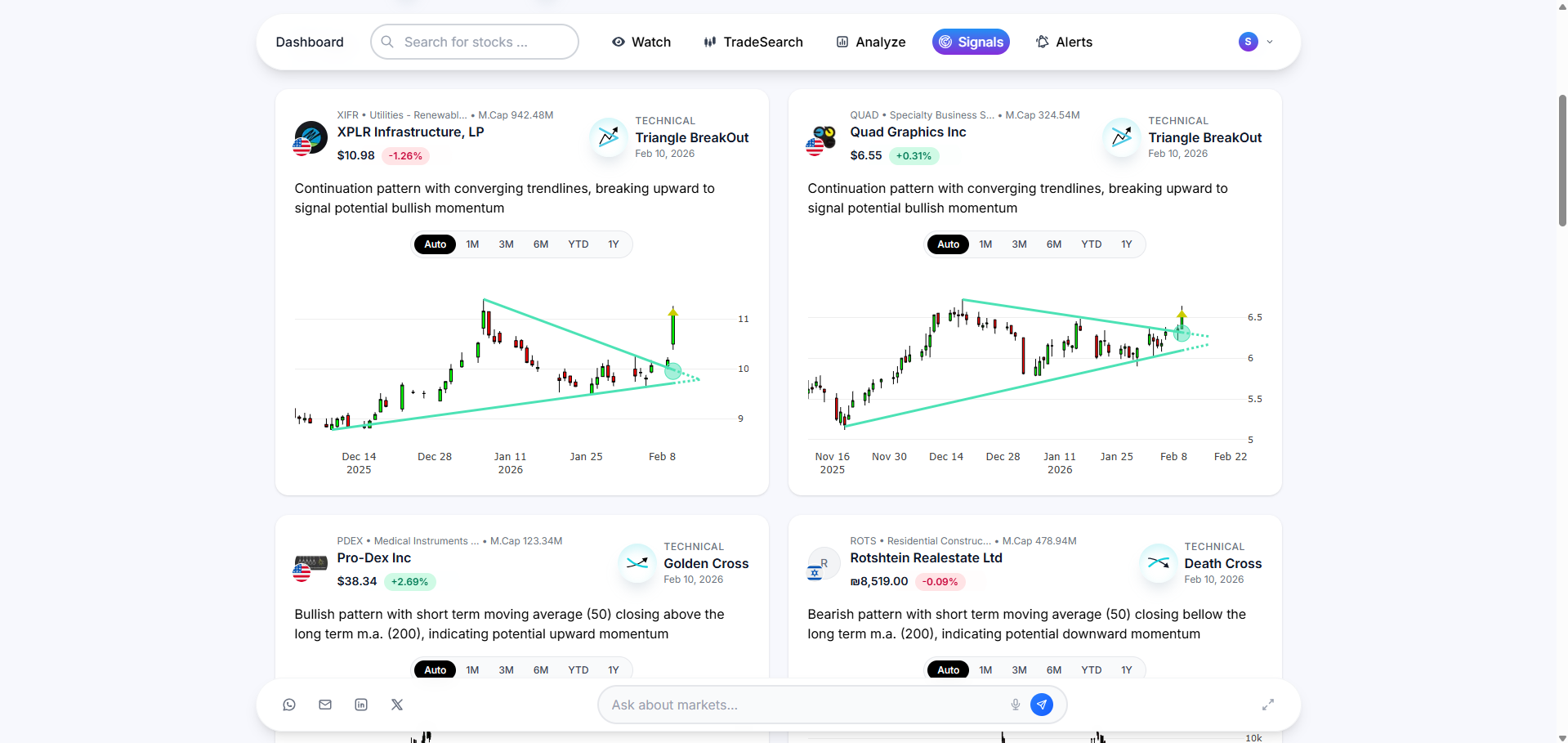

A momentum breakout trading signal occurs when a stock moves decisively above a well-defined resistance level after a period of consolidation. That level represents an area where sellers previously stepped in. When price pushes through it, the market is signaling that demand has absorbed supply and that buyers are willing to pay higher prices. In practical terms, it often marks the beginning of a new upward trend.

The problem is that not every breakout reflects real strength. Some moves above resistance are short-lived and quickly reverse. This is where high volume transaction signals become essential. Volume measures how many shares are being traded, and unusual spikes indicate that participation has increased significantly.

When volume expands sharply during a breakout, it suggests that larger investors, institutions, or concentrated capital are entering positions.

When these two signals appear together, their meaning changes. A breakout tells you price is attempting to move into a new range. A surge in volume tells you that the move is being supported by strong buying pressure. Combined, they indicate that the breakout is not random or fragile, but backed by meaningful demand.

This alignment increases the probability that momentum will continue, which is why traders often treat it as a stock signal of higher-potential investments.

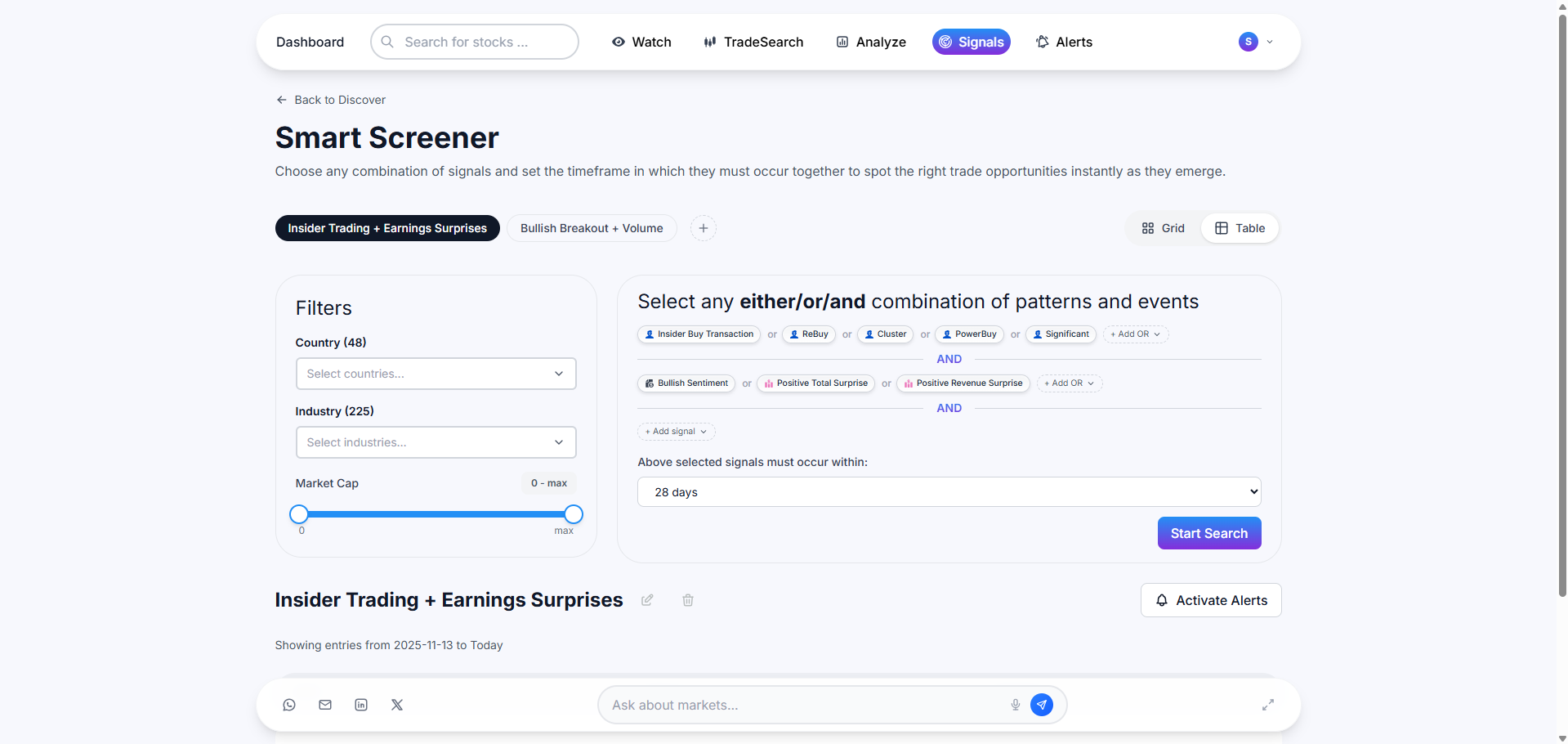

In this regard, you can use MarketAlerts to monitor real-time stock alerts and set up trading alerts for instances where a breakout coincides with unusual volume. Together, these two signals simultaneously detect the opportunity and provide the confirmation.

MarketAlerts allows you to track both elements in real time. You can set alerts for breakout technical chart patterns such as ascending triangles, bullish flags, or cup-and-handle formations, and simultaneously monitor unusual volume activity. Instead of manually scanning price charts and cross-checking transaction data, you receive confirmation the moment both conditions align.

For example, a stock breaking out of a bullish flag may look attractive on its own. If that breakout is accompanied by a sharp increase in volume or visible accumulation from institutional investors, the setup becomes far stronger. The price move suggests momentum, and the volume confirms that capital is flowing in behind it.

MarketAlerts integrates all these stock signals and allows you to set unique, customizable alerts whenever they trigger. This makes it easier to find trading ideas that are timely and actionable.

Strategy #2: Insider Buying Combined with Earnings Acceleration

Insider buying is a subtle yet powerful stock signal that many retail investors overlook. Insider trading signals refer to legal share purchases made by company executives, directors, or major shareholders who have direct knowledge of the business.

When these insiders use their own capital to buy stock on the open market, it often reflects confidence in the company’s future prospects. Unlike public commentary, insider transactions involve personal financial commitment, which can make them particularly meaningful.

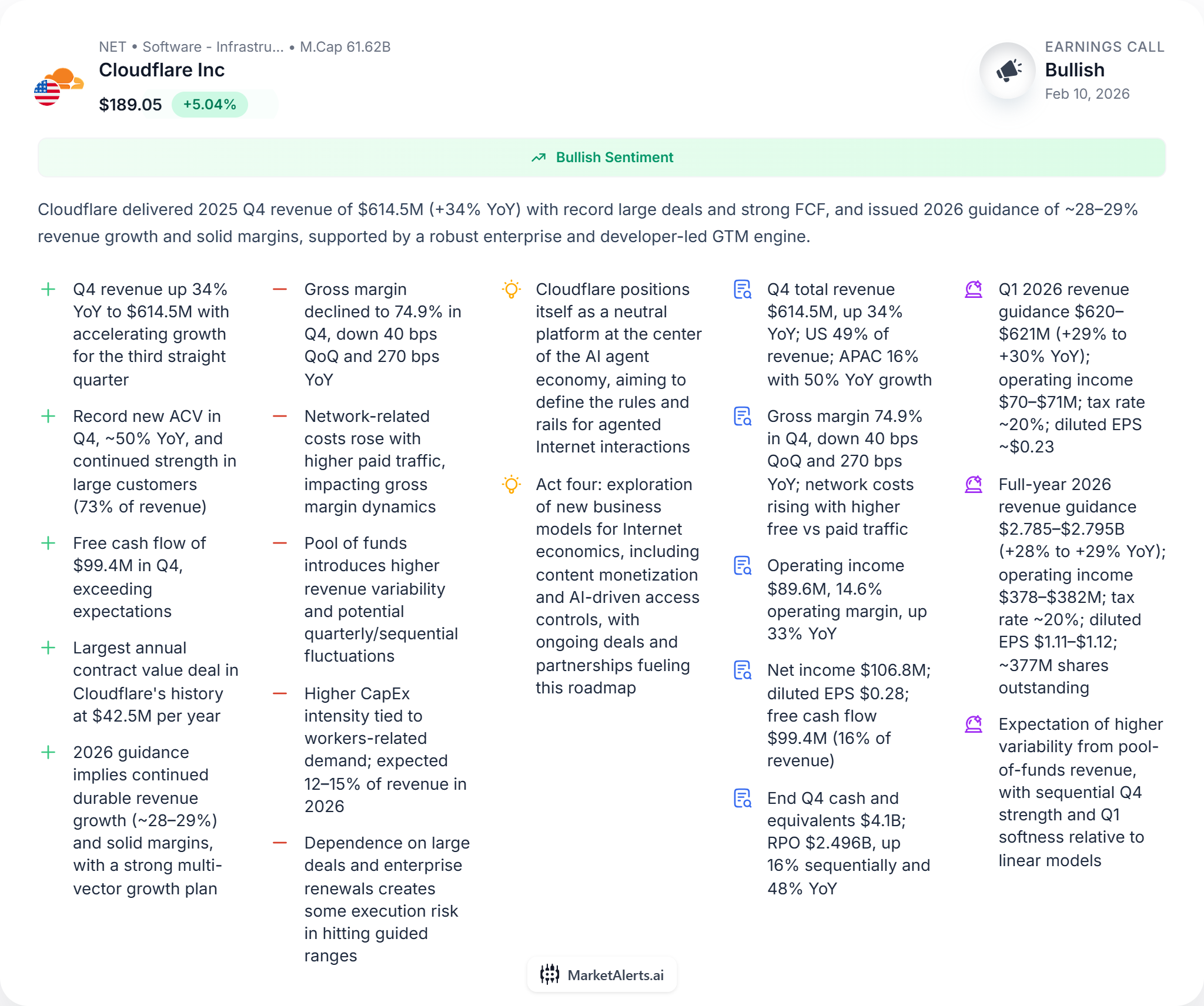

Positive earnings surprise signals, on the other hand, occur when a company reports earnings or revenue above analyst expectations. These surprises indicate that the business is performing better than the market anticipated. They often lead to upward revisions in forecasts, improved sentiment, and renewed investor interest. Consistent earnings acceleration or raised guidance further strengthens this signal by suggesting that growth is not a one-time event but part of a broader trend.

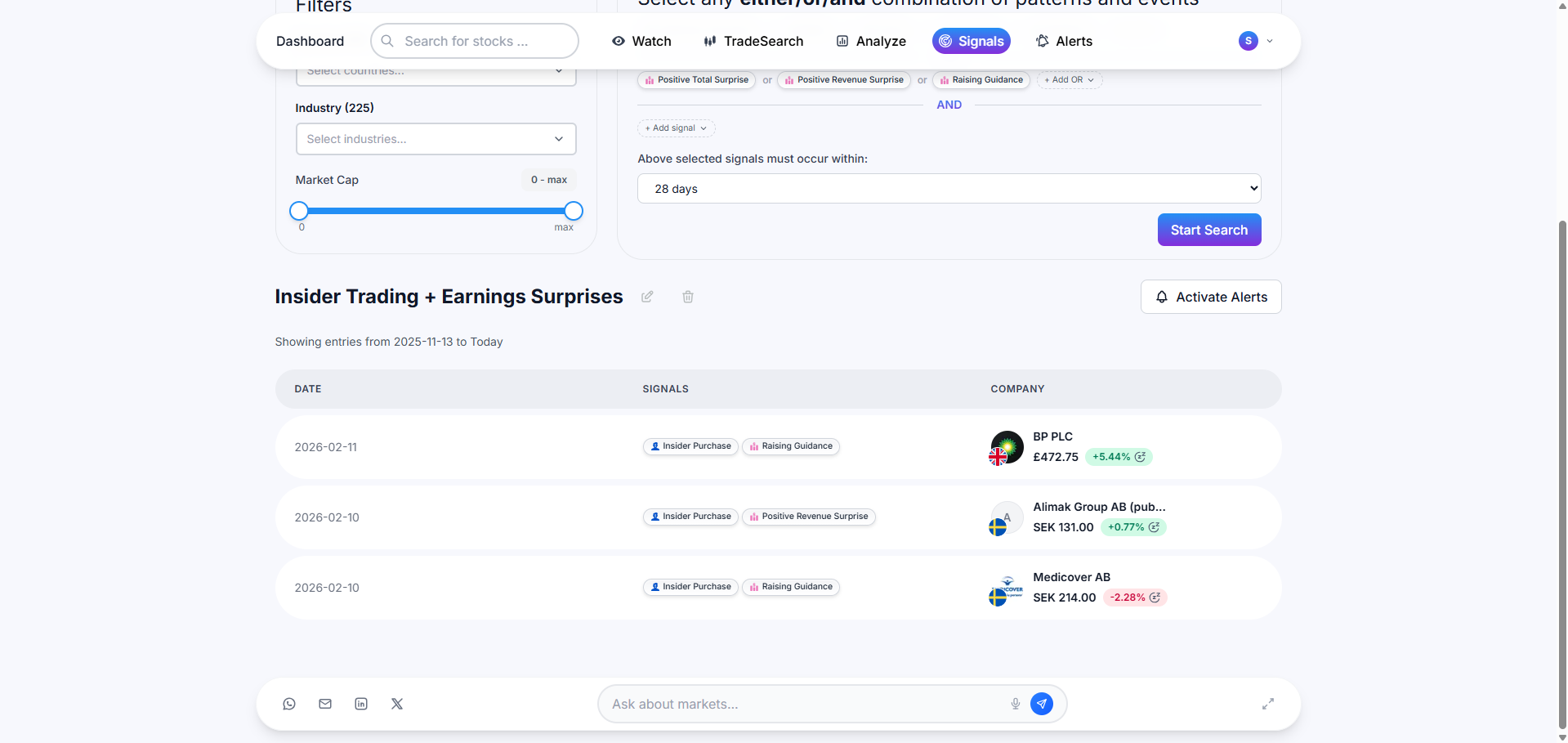

Individually, insider buying and positive earnings surprises are valuable signals. When they appear together, their significance increases. Insider accumulation suggests internal confidence in the company’s direction, while earnings surprises confirm that performance is already exceeding expectations. One reflects informed conviction from within the company, the other reflects measurable financial strength visible to the market.

Combined, they indicate alignment between management confidence and operational results, a combination that often precedes sustained stock appreciation.

MarketAlerts tracks insider trades across thousands of stocks and integrates them with earnings announcements, growth trends, and analyst projections to create unique trading alerts. A stock receiving multiple insider purchases while simultaneously reporting accelerating earnings or revenue growth becomes a strong candidate for deeper analysis.

For investors seeking additional confirmation, technical signals such as a golden cross or a bullish triangle breakout can further validate the setup. This layered approach blends fundamental strength with price confirmation, helping identify stocks that show both internal conviction and external market momentum.

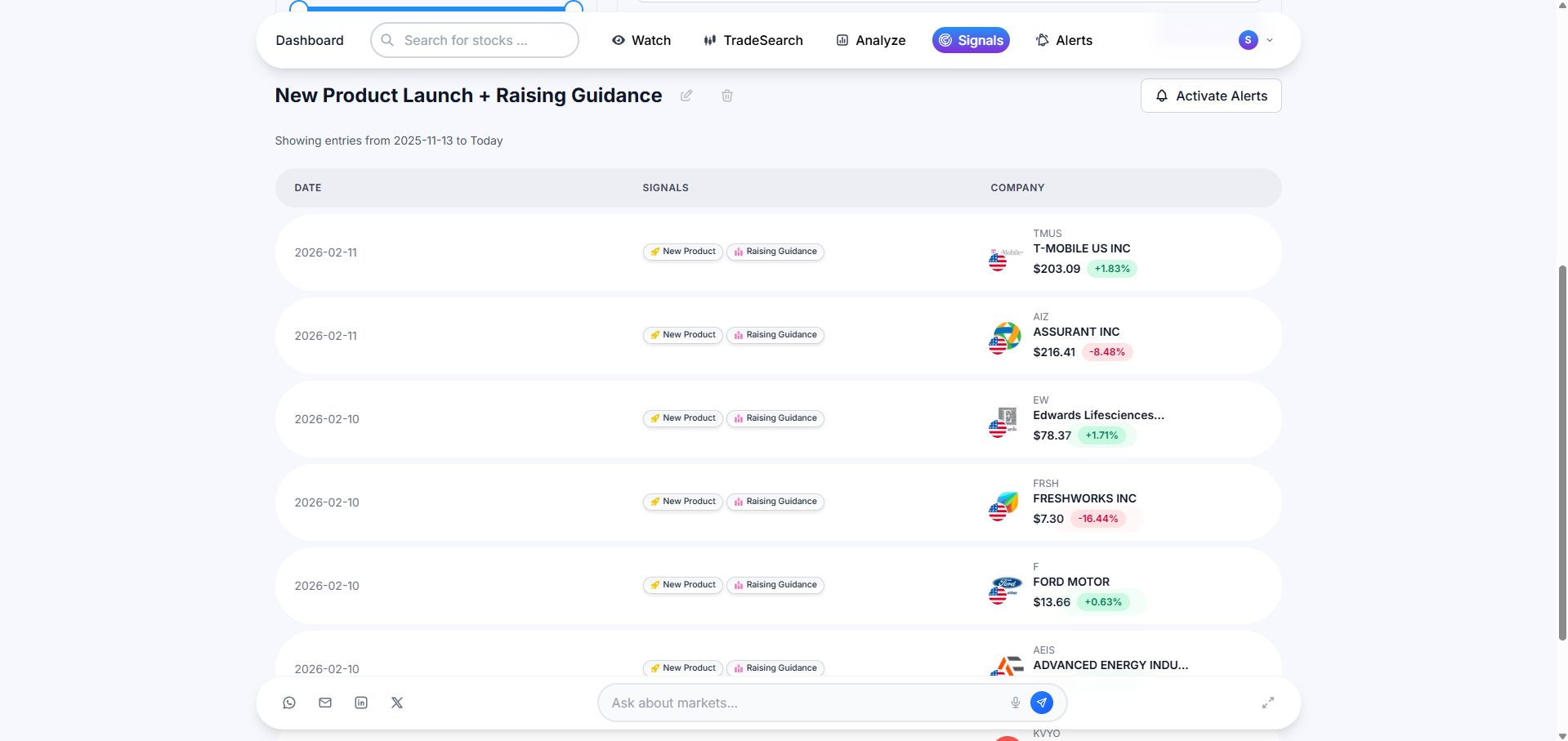

Strategy #3: AI-Powered Scans for New Product Launches and Raised Guidance

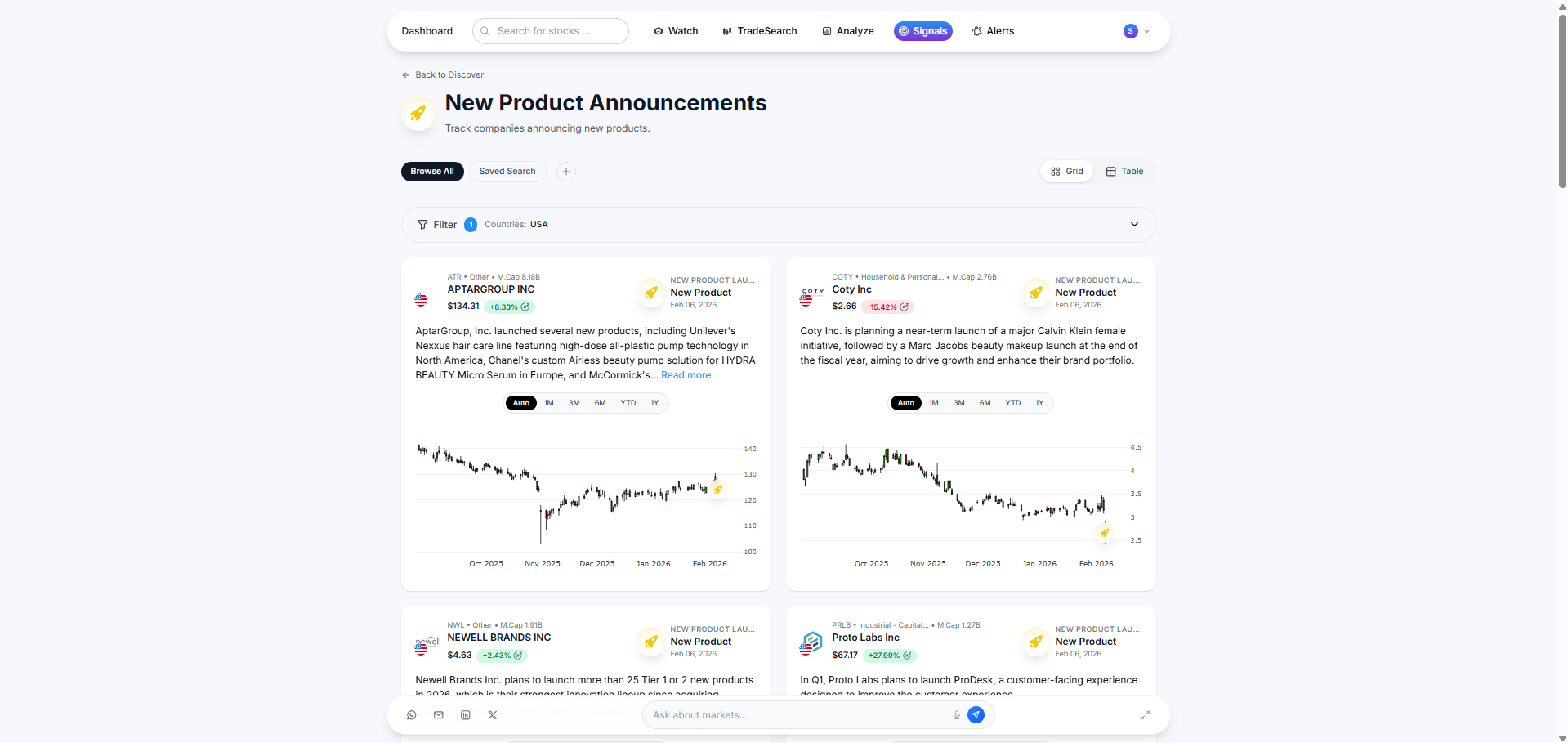

Many significant stock moves often begin with events that signal where a company is headed rather than where it has been. New product launch signals emerge when a company introduces a product or service that can expand its addressable market, strengthen its competitive position, or unlock a new revenue stream.

These announcements suggest potential future growth, especially when the product addresses a clear market need or builds on an existing strength. Investors pay attention because successful launches can materially change revenue trajectories.

On the other hand, raised financial guidance signals occur when management increases its revenue, earnings, or profitability outlook for upcoming quarters or the full year. This reflects internal visibility into demand, margins, and performance trends that justify higher expectations. When a company raises guidance, it communicates confidence that business conditions are stronger than previously anticipated. Markets often respond quickly because higher guidance can lead to upward revisions from analysts and renewed buying interest.

Individually, each of these stock signals is forward-looking. A product launch points to potential expansion, while raised guidance confirms improving performance.

When they appear together, their meaning becomes stronger. A new product suggests opportunity, and raised guidance indicates that growth is already materializing or accelerating. One represents strategic execution, the other financial validation. Combined, they highlight companies where innovation and measurable results align, which often precedes sustained price appreciation.

Finding these stock signals is not easy. You can’t find them in price charts. They are buried in news articles, press releases, social media posts, and regulatory filings. Tracking everything manually takes hours, and by the time most investors notice, the initial market reaction may have already passed.

That is why MarketAlerts has an integrated AI-powered stock market scanner that helps you detect these events as soon as they emerge. You can monitor product launches, acquisitions, and guidance revisions simultaneously and set trading alerts that trigger when multiple forward-looking catalysts align.

This approach works particularly well for growth-focused portfolios. Trading alerts that focus on product innovation supported by raised guidance help you identify emerging trends and high-conviction opportunities before the broader market fully prices them in.

Bringing It All Together: Building a High-Potential Portfolio

Using these strategies in combination allows investors to create a structured and disciplined approach to the stock market. Together, they form a comprehensive system for identifying good stocks to invest in and generating trade ideas with higher probability outcomes.

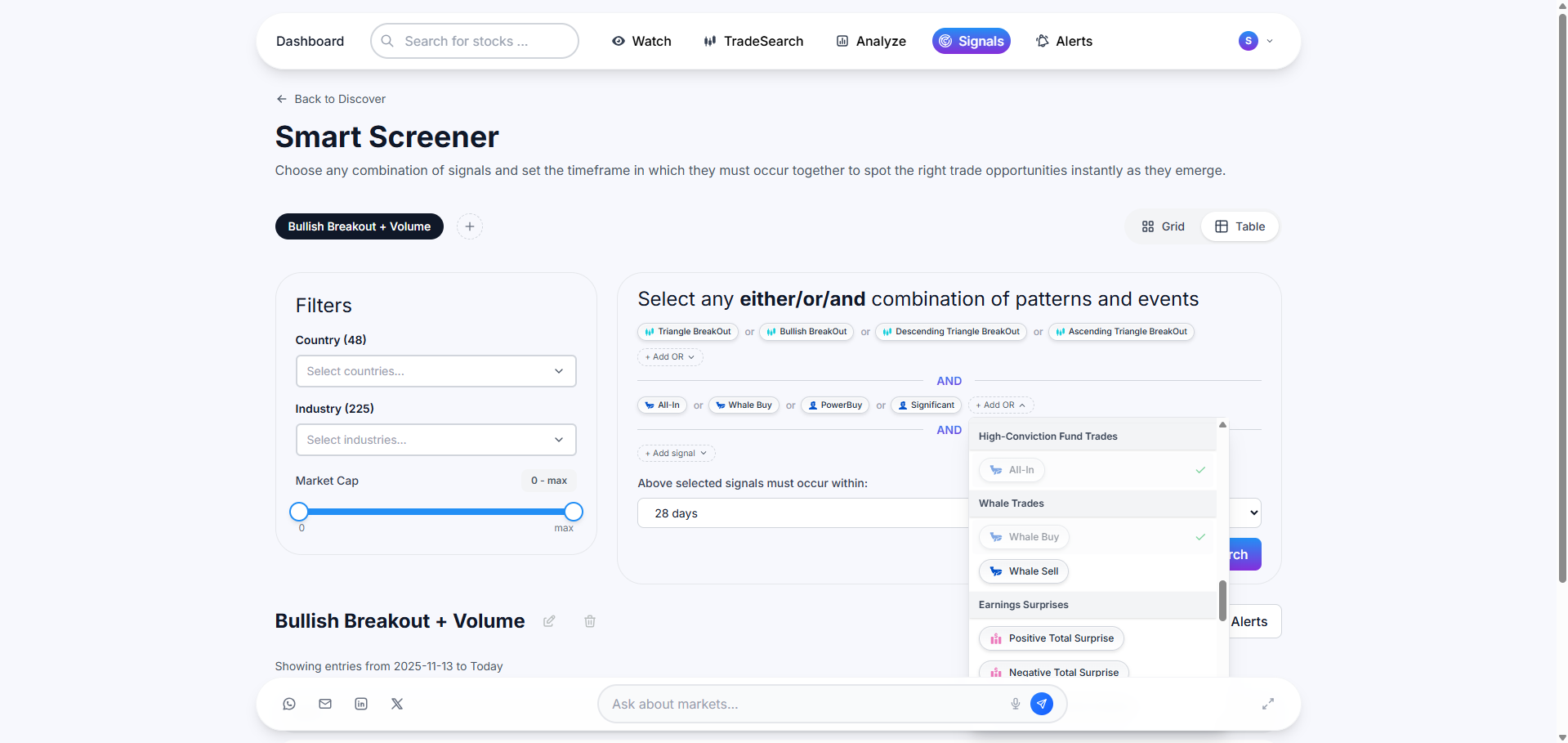

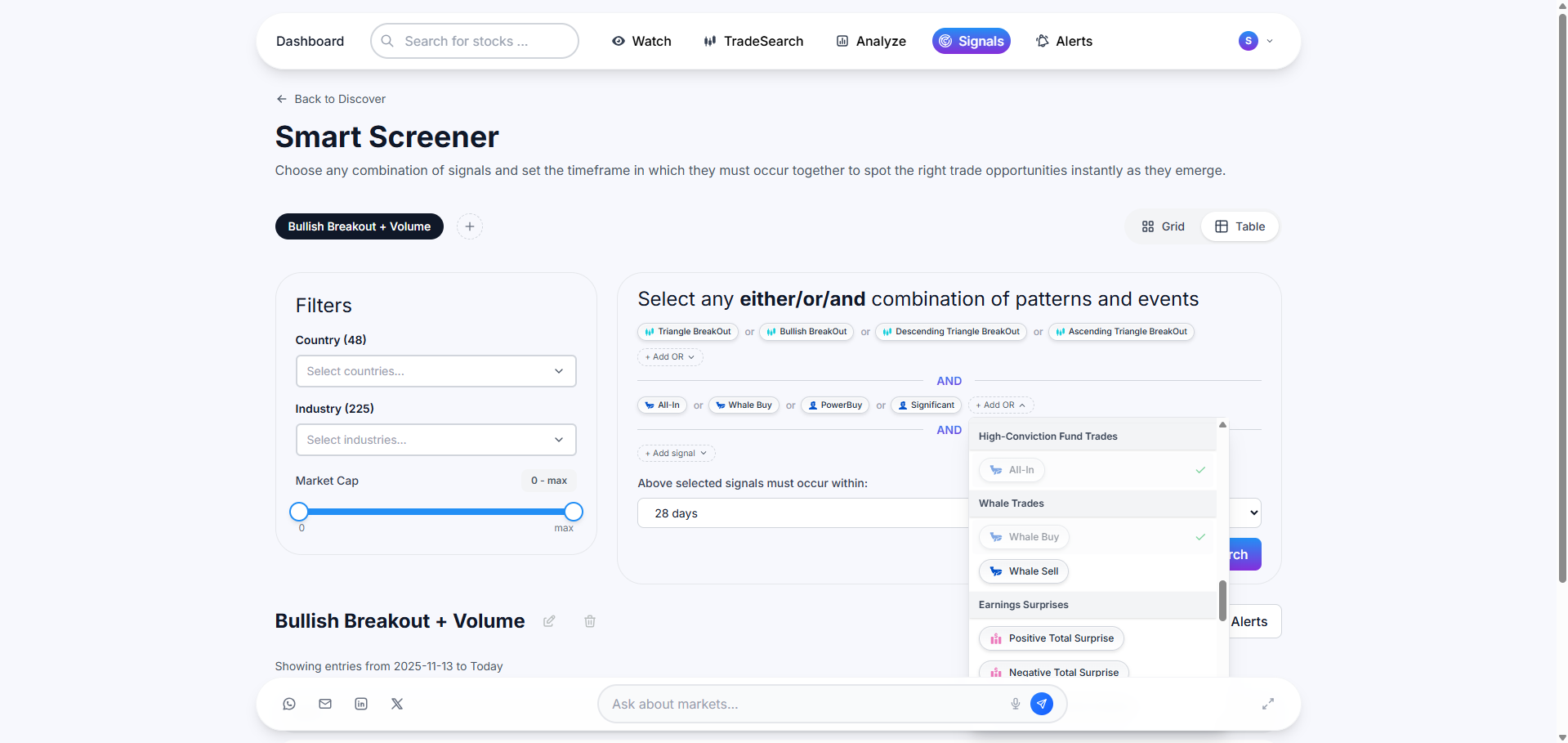

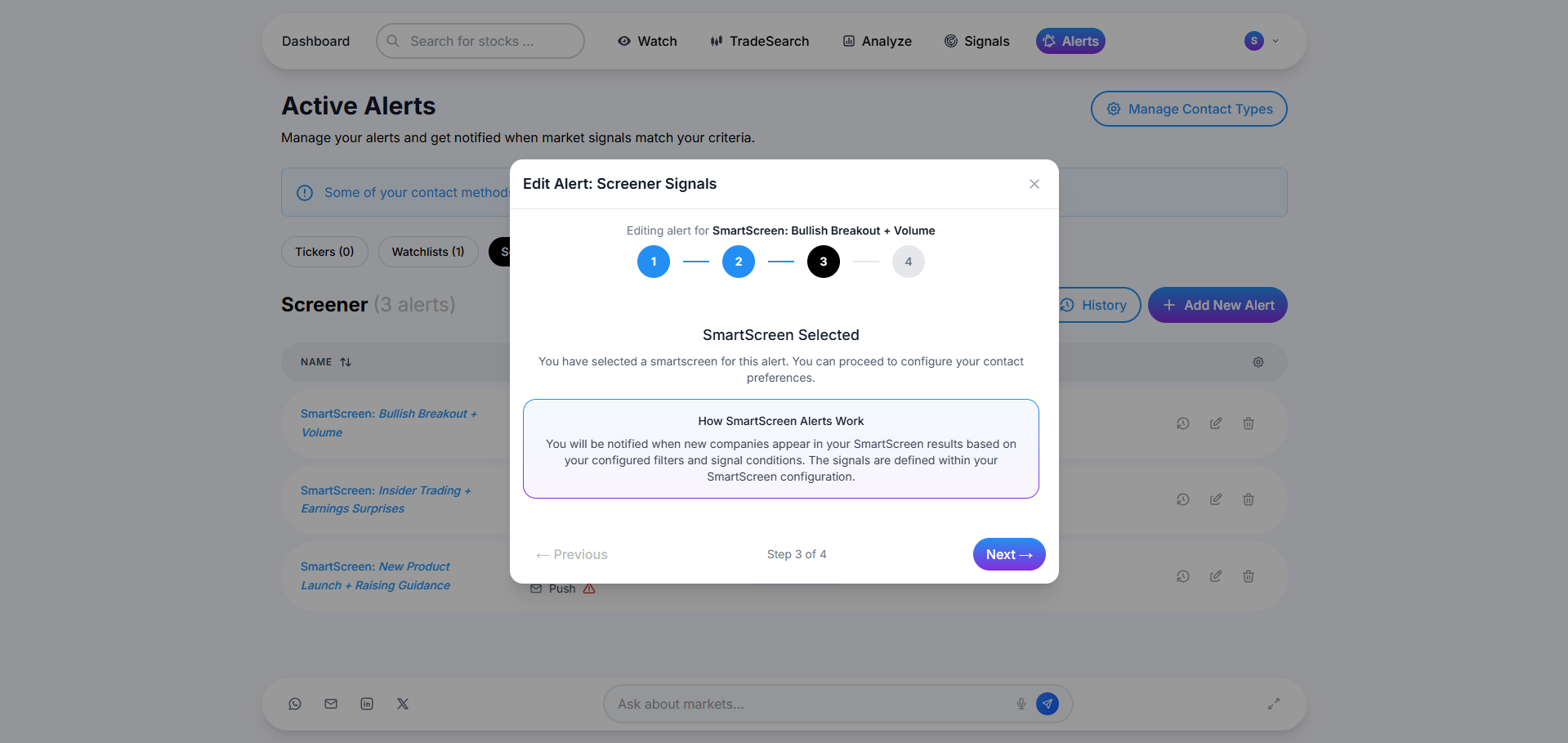

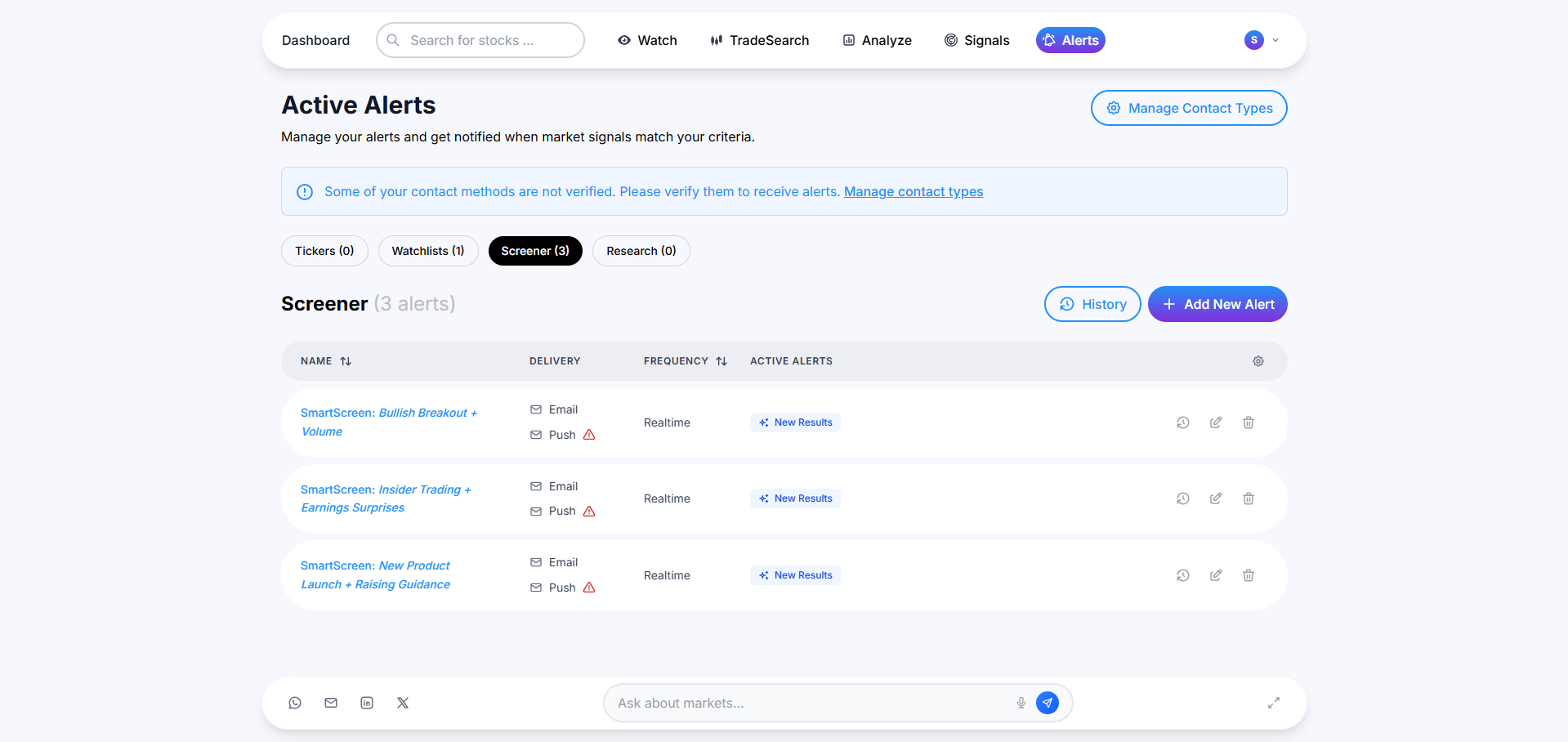

Start by tracking these stock signals (or others you might find interesting) using the Smart Screener feature in MarketAlerts. Monitor momentum breakouts for short-term opportunities, track insider and earnings signals for medium-term trends, and overlay chart pattern confluence to identify reliable setups.

Simultaneously, integrate AI-powered trading alerts for when these signals emerge, allowing you to act immediately and capture every opportunity.

This approach reduces guesswork, increases confidence in trade decisions, and ensures your portfolio is aligned with high-potential opportunities. The combination of technical, fundamental, and institutional stock signals provides an edge that is difficult to replicate without advanced monitoring tools.

Investors who consistently apply these strategies report not only improved returns but also a clearer understanding of market dynamics. They stop reacting to noise and start making informed decisions based on structured, data-driven insights.

Combining these stock signals and trading alerts gives you a roadmap to discover the best stocks to invest in and build a portfolio designed for sustained growth.

Putting These Stock Signals and Trading Alerts into Action

Knowing the strategies is only the first step. Applying them consistently and systematically to find opportunities is the real advantage.

Now, each of these three approaches requires monitoring multiple stock signals simultaneously. Doing this manually is time-consuming, and missing even a single trading alert can mean missing a high-potential opportunity.

This is where a unified platform like MarketAlerts becomes invaluable. It allows you to create a tailored stock watchlist that captures all the signals discussed. You can track momentum breakouts, insider activity, chart patterns, and institutional trades in real time, all in one place. The system automatically generates trading alerts whenever a potential setup aligns with your chosen criteria, giving you actionable insights without having to scan dozens of sources manually.

Essentially, it’s a central hub for spotting and acting on high-potential stocks, giving investors the ability to implement these strategies efficiently and consistently.

Using an all-in-one platform also encourages disciplined investing. Instead of reacting to scattered headlines or impulsively trading based on partial information, you have a structured system guiding your decisions. Over time, this approach builds confidence, refines your market intuition, and ensures that your portfolio focuses on the most promising opportunities.

In short, these strategies are most powerful when applied in a coordinated way. Platforms that aggregate stock signals, trading alerts, and AI-driven insights allow you to move from understanding the theory to taking real, actionable steps in the market.

Turning Stock Signals into Consistent Investment Results With Trading Alerts

Stock signals are a lens through which you can understand the market before everyone else does.

Individually, each signal is powerful. Together, they form a multi-layered system that can help you find the best stocks to invest in. The true advantage comes from consistency and structure: monitoring stock signals, building a disciplined watchlist, and acting when conditions align. This approach transforms investing from reactive guessing into strategic decision-making.

For investors committed to improving their results, the key is to act deliberately. Start by identifying which of these strategies fits your style and risk tolerance. Use your watchlist to monitor multiple signals simultaneously, refine your criteria based on experience, and set up AI-powered trading alerts to ensure you never miss a high-potential opportunity.

Over time, this structured approach not only improves your ability to spot good stocks to invest in but also strengthens your understanding of market dynamics, helping you make smarter, more confident decisions.