Many traders make the same mistake for many years, and they miss out on incredible opportunities because of it: they believe trading alerts are simply notifications that tell them when to act.

A stock alert would pop up, they would check the chart, and decide whether to jump in. On paper, it sounds like a smart system. In reality, it is the reason they keep missing the best opportunities.

This happens because most traders rely on stock price alerts to guide their decisions. Breakouts, percentage moves, volume spikes, intraday highs. The alerts are constant, yet the results are inconsistent. If you do this, you already know how it goes: you feel busy, informed, and reactive, but the numbers tell a different story.

Over time, you realize the problem is not a lack of trading alerts., but that you are using them wrong.

That shift in understanding completely changed how we approach trading signals, stock alerts, and decision making in the market, and it can change how you do it too. In this article, we will tell you what we learned and how you can use trading alerts to become a successful trader.

Why Most Invest Use Stock Trading Alerts Wrong

Trading alerts are essential if you want exposure to real opportunities. No trader can manually track thousands of symbols, earnings reports, filings, and news events. Alerts exist to expand your awareness and save time.

However, most trading alerts focus almost entirely on price. And this is a limitation.

Traditional stock price alerts trigger when a level breaks or a move is already in progress. You get notified when a stock reaches a certain price or breaks through a specific resistance.

The problem is that by the time a stock alert fires, you are no longer early. You are responding to something that already happened. The opportunity is gone. That is why so many traders feel late, rushed, or uncertain.

This is also why most stock alert services often feel noisy. They tell you when price moves, but not why it moves. They’re even counter-productive: they generate anxiety and fear of missing out, pushing you to make rushed decisions which often lead to bad trades.

It’s like using a rear-view mirror to navigate forward. You’re always looking at what just happened, not what’s forming ahead of you. You don’t see the curve in the road, the traffic building, or the slowdown coming. You only see the brake lights after everyone else has already hit them.

Without context, trading decisions become emotional. You hesitate, chase, exit too early, or hold too long. The alert gives you information, but not understanding.

Start using trading alerts that give you real signals on MarketAlerts.ai.

The Best Trading Alerts Show You Why Stocks Move

To understand what trading alerts should do, you first need to understand what moves markets.

Prices move because something changes beneath the surface. Earnings expectations shift. Analysts revise their outlook. Insiders buy or sell. Institutions reposition. A filing reveals new information. Sentiment quietly changes before it shows up on a chart.

These are trading signals in their purest form. They are the cause, not the effect. That’s why we call it “smart money.”

Most investors focus on finding the best stocks for day trading by scanning charts alone. The best investors, on the other hand, focus on identifying equity trading signals that explain why those stocks might move in the first place.

Once you start focusing on these signals, the market becomes clearer. Instead of asking when to enter after a breakout, start asking why a stock might move at all.

That mindset shift made every alert more meaningful.

Now, let’s dive into how exactly you can start using these alerts to improve your investing game.

How to Use Trading Alerts More Effectively

If you want better results, the answer is not adding more stock alerts to your phone. It is changing how you use trading alerts in the first place.

Treating Stock Alerts as Stock Signals

The first practical step is to stop treating trading alerts as entry points. A stock alert should not tell you to buy or sell. It should tell you where to look. When an alert fires, your job is not to act immediately, but to investigate why it triggered and whether the situation fits your strategy.

Instead of setting dozens of stock price alerts at random levels, start by defining what kind of opportunity you are actually looking for. Do you prefer to ride the market wave or are you a contrarian investor? Are you trading momentum, reversals, breakouts, or intraday continuation moves? Each of those setups has different signals that matter before price moves.

This is where most investors go wrong. They look for the best stocks by scanning price alone, when price is usually the last thing to change.

A more effective approach is to build trading alerts around catalysts. Use alerts that track unusual volume before a breakout, abnormal options activity, insider buying, analyst upgrades, earnings expectation shifts, or sudden changes in fundamentals. These are early stock signals that something is developing, not confirmations that it already happened.

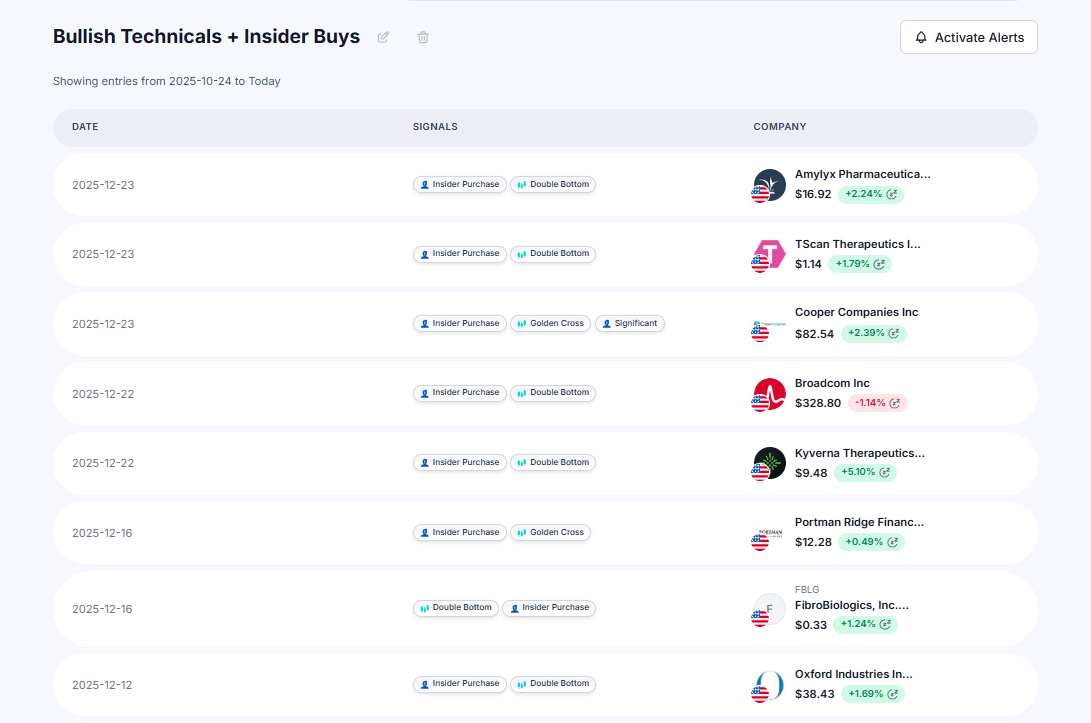

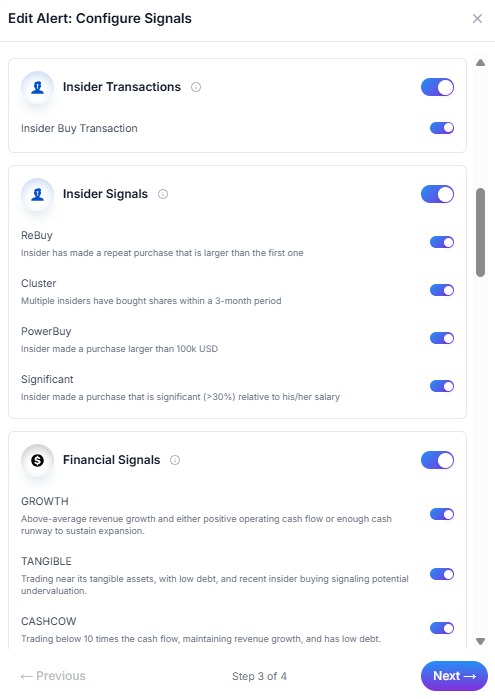

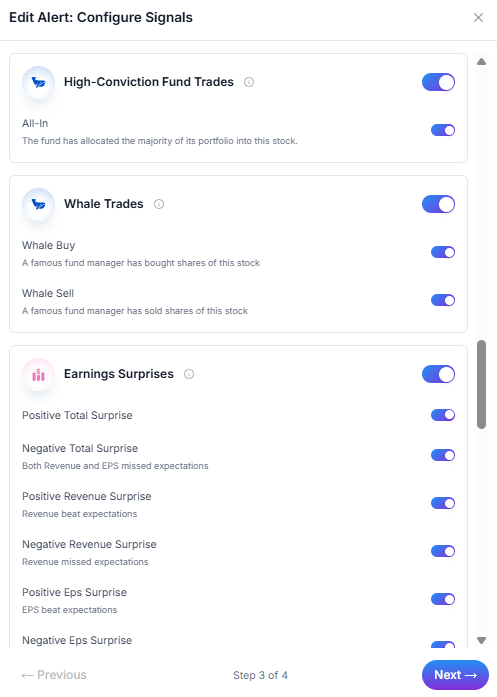

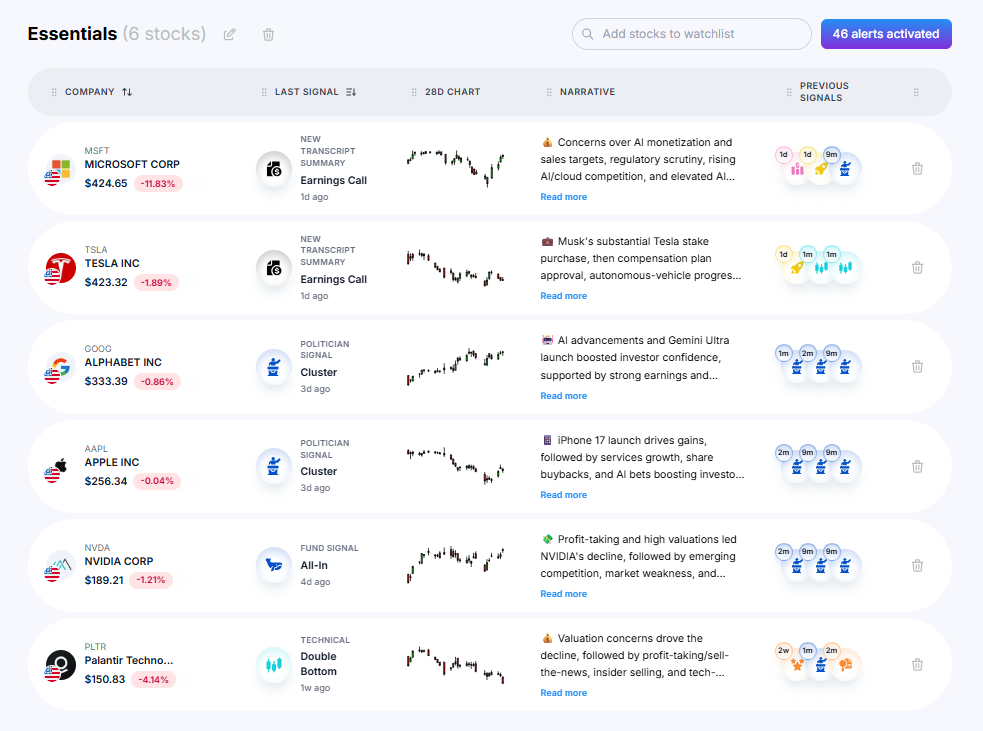

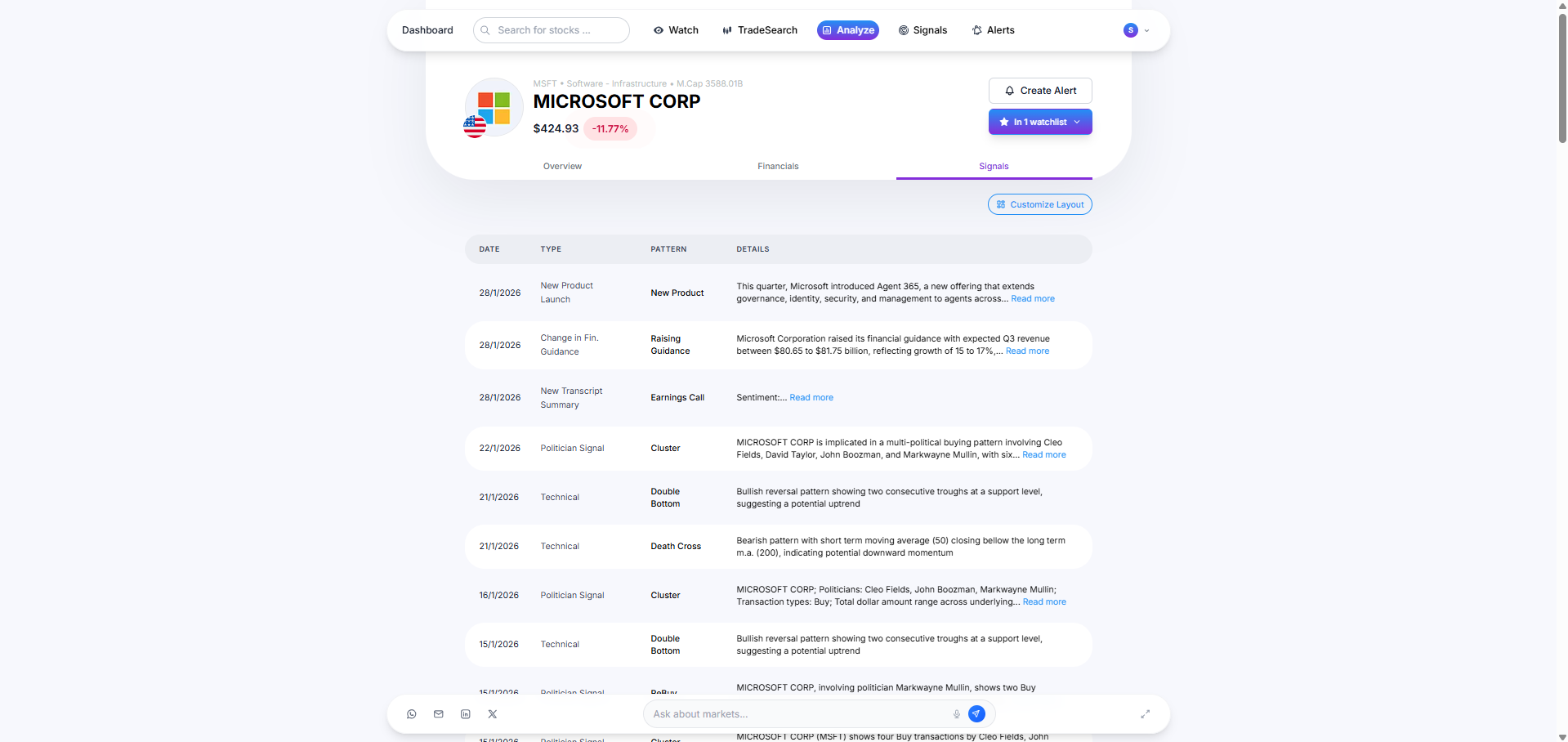

With MarketAlerts, this becomes practical. Instead of a single stock price alert, you can combine multiple factors into one workflow. For example, you can monitor stocks showing early technical patterns while simultaneously flagging unusual insider activity or analyst revisions. When several signals align, the alert becomes meaningful.

Using the SmartScreener feature, you can create customized lists and alerts that trigger when your selected conditions are met, allowing you to stay one step ahead of the market at all times. Create your free MarketAlerts.ai account and level up your investing game with SmartScreener.

With Trading Alerts, Quality Matters More Than Quantity

Another actionable improvement is to limit how many alerts you allow yourself to receive. Too many alerts train you to ignore them. Start by narrowing your focus to a small universe of stocks, sectors, or market caps you understand well, as well as signals you care about and fit into your strategy.

If you’re a long-term value investor, you don’t need to distract or confuse yourself with short-term technical patterns. Instead, pay attention to earnings surprises, financial statement patterns, analyst rating changes, and so on.

These undervalued stocks often come from familiar territory, not from scanning the entire market blindly.

Set alerts that notify you only when something changes materially. Filter by country, market cap, industry, and signal type to eliminate noise and keep your attention on situations that deserve it. You can do this in minutes on MarketAlerts.

And, once an alert triggers, pause and document what you see. Ask yourself three simple questions: what changed, why might the market care, and what would invalidate this idea? This habit alone improves decision making dramatically.

Trading alerts are most powerful when they lead to analysis, not impulse.

Adjust Your Trading Alerts as the Situation Requires

You should also separate alerts by purpose. Use some trading alerts strictly for awareness and others for execution. Awareness alerts surface developing situations. Execution alerts help with timing once you already have context. Most investors mix these together and end up reacting emotionally.

Finally, review your trading alerts regularly. If an alert fires often but never leads to a trade or insight, remove it. If certain alerts consistently point you toward high quality opportunities, double down on those. Treat your alert system as a living strategy, not a static tool.

When trading alerts are used this way, they stop being distractions and start acting like a personal market radar. They guide your attention to the right places at the right time, while still leaving the decision in your hands.

That is the difference between reacting to the market and reading it with intention.

Why MarketAlerts Stands Out Among Stock Alert Services

If you are a little overwhelmed about everything we talked about in this article, don’t worry. It’s easier than it seems once you get the hang of it. And with MarketAlerts, it takes but a couple of minutes to get started.

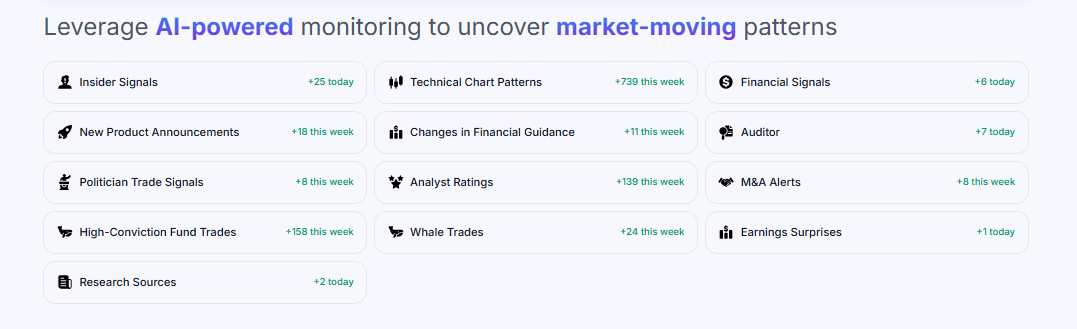

Instead of flooding you with basic stock alerts, MarketAlerts allows you to create customizable ones based on high-value trading signals. These include technical, fundamental, insider, analyst, and corporate signals, all in one place.

Our platform uses advanced AI to scan the market, as well as thousands of data sources and news platforms. Whenever it finds something relevant that could affect the market, it synthesizes the information to create a digestable, actionable alert delivered in real time.

MarketAlerts is the best stock alert app because the quality of our signals is unmatched and the user (meaning you) has complete control. It’s a platform that helps you understand what is changing before price reacts.

For investors searching for the best stock alert service, free stock alerts apps that actually provide insight, or AI trading signals that add real context, this approach makes a meaningful difference.

MarketAlerts does not tell you what or when to invest. It helps you understand the stock signals driving the market so you can make your own informed decisions.

When you combine context with timing, trading alerts stop being noise and start becoming an edge. Once you experience that shift, it is very hard to go back.

Create your free MarketAlerts account and start using trading signals to spot hidden opportunities.

What Are Trading Signals and Why They Matter

In MarketAlerts, trading signals go hand in hand with stock alerts, but they are fundamentally different.

Trading signals are indicators of potential future price movement based on meaningful changes in data. This includes fundamental shifts, insider activity, analyst revisions, and unusual market behavior.

Unlike basic stock price alerts, trading signals provide context. They explain what is changing and why it might matter. When a price move finally happens, it no longer feels random. You are prepared, not surprised. That preparation is what separates reactive traders from disciplined ones.

How Signal-Based Trading Alerts Improve Decision Making

MarketAlerts’ signal-based trading alerts work quietly in the background. They do not scream after price moves, but rather surface early signs of change before the market fully reacts.

These AI alerts highlight trading signals stocks are generating before they become obvious, revealing catalysts that often lead to sustained moves.

This approach transforms decision making. It helps you stop chasing momentum and start positioning with intention. You can evaluate whether a move has real backing or is just noise.

That context allows you to ignore weak setups, focus on high quality opportunities, and invest with far more confidence.

Good Trading Alerts Are What You’re Missing to Become a Successful Investor

Trading success rarely comes from reacting faster. It comes from understanding earlier. When you stop using alerts as commands and start using them as context, the market becomes quieter, clearer, and far more manageable. You are no longer chasing moves or guessing why something is happening. You are watching conditions develop with intention.

That is what the right trading alerts are meant to do. Not overwhelm you with noise, but guide your attention to meaningful change. Not tell you what to buy or sell, but help you recognize when something truly matters. MarketAlerts is built around that philosophy, giving you visibility into the signals that drive price before they become obvious.

When alerts provide context, decision making improves, confidence increases, and emotional reactions fade. You stop feeling late, rushed, or surprised by the market. Instead, you start approaching it with clarity and control. Once you experience that shift, trading stops feeling chaotic and starts feeling deliberate. And that difference is what separates the majority from the few who consistently stay ahead.

If you're not using stock alerts the right way, you're missing out on countless opportunities. Go to MarketAlerts.ai and start investing smarter with the best stock alerts.